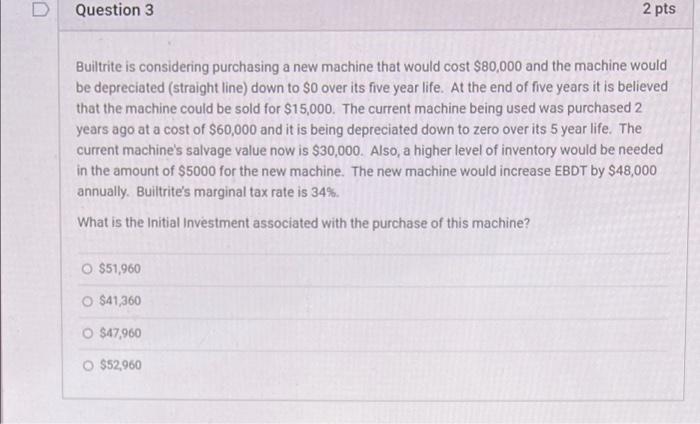

Question: D Question 3 2 pts Builtrite is considering purchasing a new machine that would cost $80,000 and the machine would be depreciated (straight line) down

D Question 3 2 pts Builtrite is considering purchasing a new machine that would cost $80,000 and the machine would be depreciated (straight line) down to So over its five year life. At the end of five years it is believed that the machine could be sold for $15,000. The current machine being used was purchased 2 years ago at a cost of $60,000 and it is being depreciated down to zero over its 5 year life. The current machine's salvage value now is $30,000. Also, a higher level of inventory would be needed in the amount of $5000 for the new machine. The new machine would increase EBDT by $48,000 annually. Builtrite's marginal tax rate is 34%. What is the Initial Investment associated with the purchase of this machine? O $51,960 O $41,360 O $47,960 O $52,960

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts