Question: D Question 3 4 pts Gains differ from revenues because gains: are not a result of the entity's ongoing, central operations. do not have to

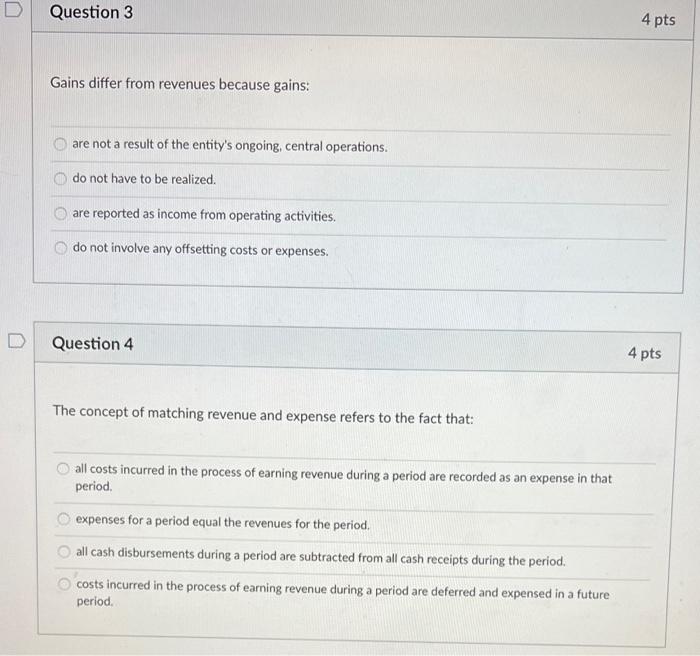

D Question 3 4 pts Gains differ from revenues because gains: are not a result of the entity's ongoing, central operations. do not have to be realized. are reported as income from operating activities. do not involve any offsetting costs or expenses. D Question 4 4 pts The concept of matching revenue and expense refers to the fact that: all costs incurred in the process of earning revenue during a period are recorded as an expense in that period expenses for a period equal the revenues for the period. all cash disbursements during a period are subtracted from all cash receipts during the period. costs incurred in the process of earning revenue during a period are deferred and expensed in a future period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts