Question: D Question 4 1 pts Consider a stock whose price at time is given by S, and that follows a geometric Brownian motion (GBM). The

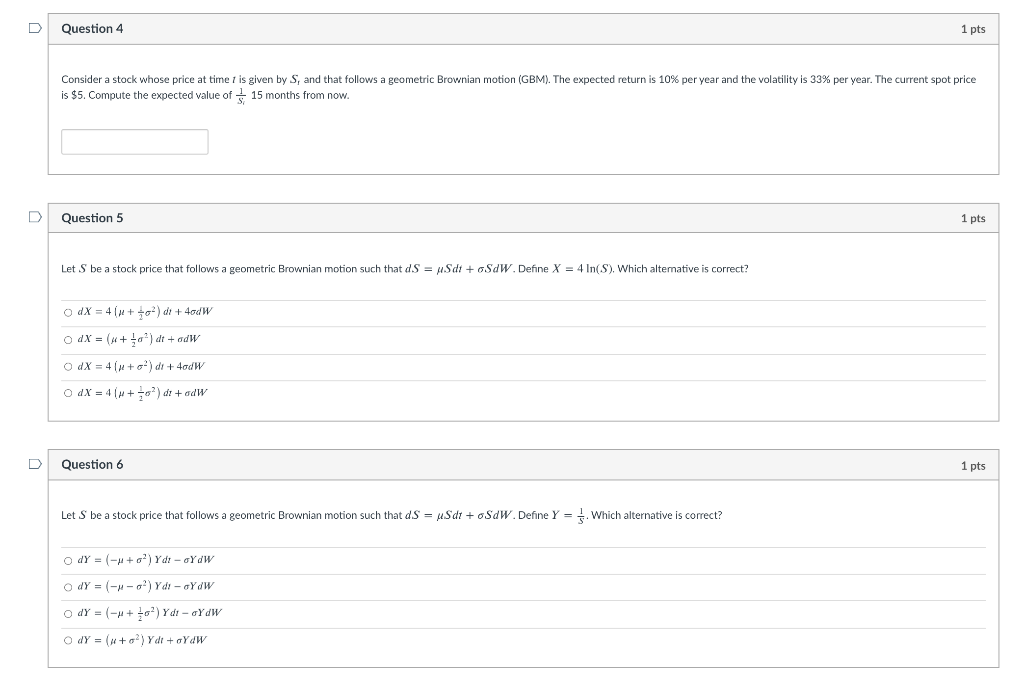

D Question 4 1 pts Consider a stock whose price at time is given by S, and that follows a geometric Brownian motion (GBM). The expected return is 10% per year and the volatility is 33% per year. The current spot price is $5. Compute the expected value of $ 15 months from now. Question 5 1 pts Let S be a stock price that follows a geometric Brownian motion such that ds = ySdt + SdW.Define X = 4 In(S). Which alternative is correct? OdX = 4(x + 1) d+ 400W OdX = (x+4) dt + odW OdX = 418 + 6 ) di + 400W OdX = 4 14 +62) dr + odW D Question 6 1 pts Let S be a stock price that follows a geometric Brownian motion such that ds = uSdt + SdW.Define Y = 5. Which alternative is correct? ODY = (-" + o) Ydt- oYdW OdY = (---) Ydi-OY W OdY = (-+ ?) Ydi - YOW OdY = (x+2) Ydi + Y JW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts