Question: D Question 4 20 pts MCG Constructions Cois current return on equity (ROE) IS 11.5%. It pays out 60% of its earnings as cash dividenck.

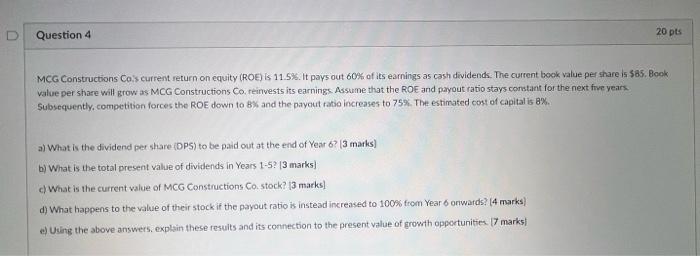

D Question 4 20 pts MCG Constructions Cois current return on equity (ROE) IS 11.5%. It pays out 60% of its earnings as cash dividenck. The current book value per share is $85. Book value per share will grow as MCG Constructions Co. reinvests its earnings. Assume that the ROE and payout ratio stays constant for the next five years Subsequently, competition forces the ROE down to 8% and the payout ratio increases to 75%. The estimated cost of capital is 8%. a) What is the dividend per share (DPS) to be paid out at the end of Year 6? [3 marks) b) What is the total present value of dividends in Years 1-5? [3 marks) c) What is the current value of MCG Constructions Co stock? [3 marks) d) What happens to the value of their stock if the payout ratio is instead increased to 100% from Year 6 onwards? [4 marks e) Using the above answers, explain these results and its connection to the present value of growth opportunities. 17 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts