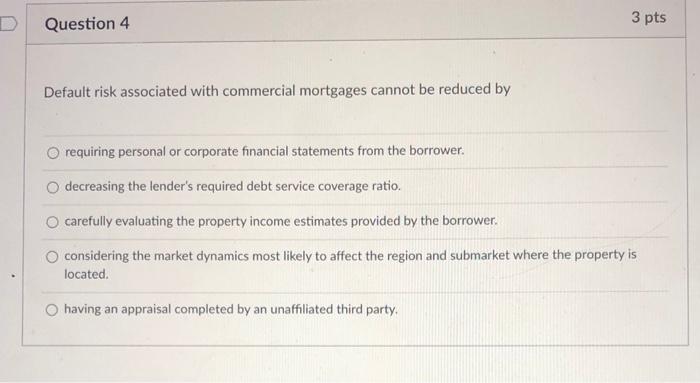

Question: D Question 4 3 pts Default risk associated with commercial mortgages cannot be reduced by requiring personal or corporate financial statements from the borrower. o

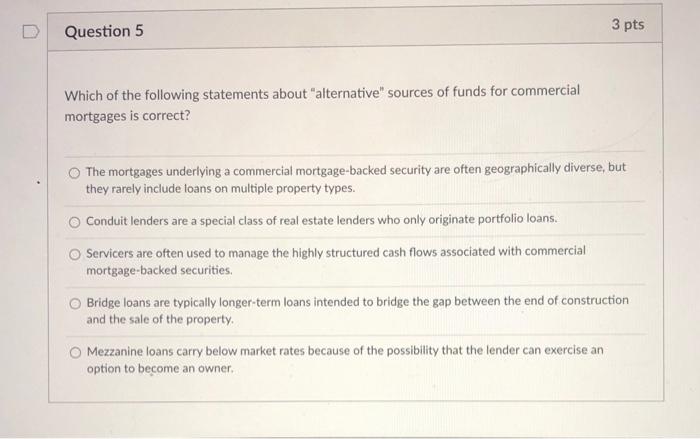

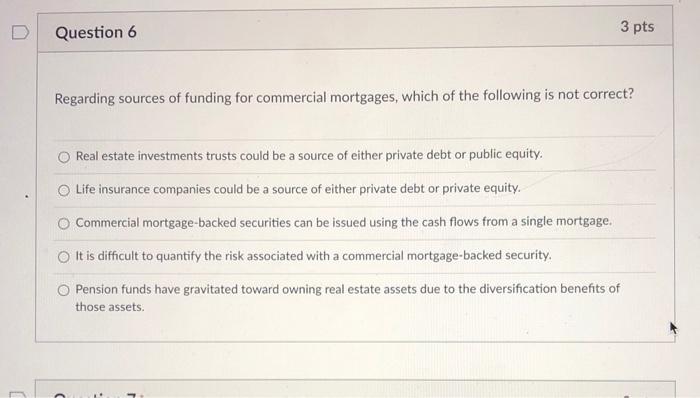

D Question 4 3 pts Default risk associated with commercial mortgages cannot be reduced by requiring personal or corporate financial statements from the borrower. o decreasing the lender's required debt service coverage ratio. carefully evaluating the property income estimates provided by the borrower. considering the market dynamics most likely to affect the region and submarket where the property is located having an appraisal completed by an unaffiliated third party Question 5 3 pts Which of the following statements about "alternative" sources of funds for commercial mortgages is correct? The mortgages underlying a commercial mortgage-backed security are often geographically diverse, but they rarely include loans on multiple property types. Conduit lenders are a special class of real estate lenders who only originate portfolio loans. Servicers are often used to manage the highly structured cash flows associated with commercial mortgage-backed securities, Bridge loans are typically longer-term loans intended to bridge the gap between the end of construction and the sale of the property. O Mezzanine loans carry below market rates because of the possibility that the lender can exercise an option to become an owner. Question 6 3 pts Regarding sources of funding for commercial mortgages, which of the following is not correct? . Real estate investments trusts could be a source of either private debt or public equity. Life insurance companies could be a source of either private debt or private equity. o Commercial mortgage-backed securities can be issued using the cash flows from a single mortgage It is difficult to quantify the risk associated with a commercial mortgage-backed security. O Pension funds have gravitated toward owning real estate assets due to the diversification benefits of those assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts