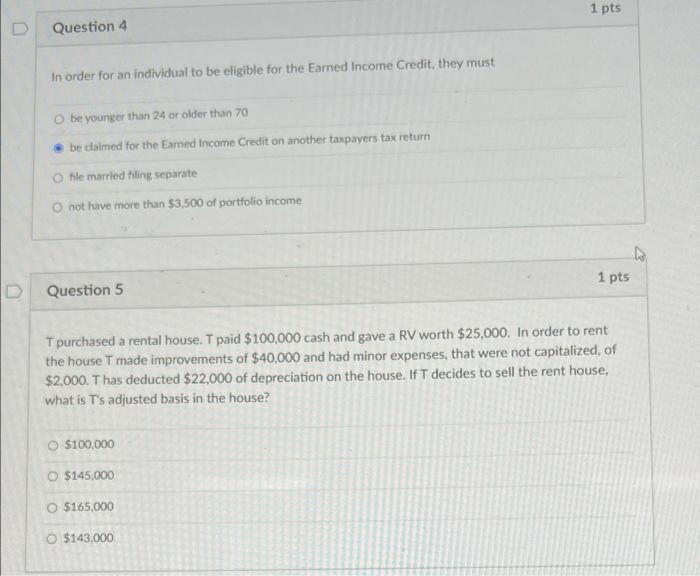

Question: D Question 4 In order for an individual to be eligible for the Earned Income Credit, they must O be younger than 24 or

D Question 4 In order for an individual to be eligible for the Earned Income Credit, they must O be younger than 24 or older than 70 be claimed for the Eamed Income Credit on another taxpayers tax return O file married filing separate O not have more than $3,500 of portfolio income D Question 5 1 pts 1 pts T purchased a rental house. T paid $100,000 cash and gave a RV worth $25,000. In order to rent the house T made improvements of $40,000 and had minor expenses, that were not capitalized, of $2,000. T has deducted $22,000 of depreciation on the house. If T decides to sell the rent house, what is T's adjusted basis in the house? O $100,000 O $145,000 O $165,000 O $143,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts