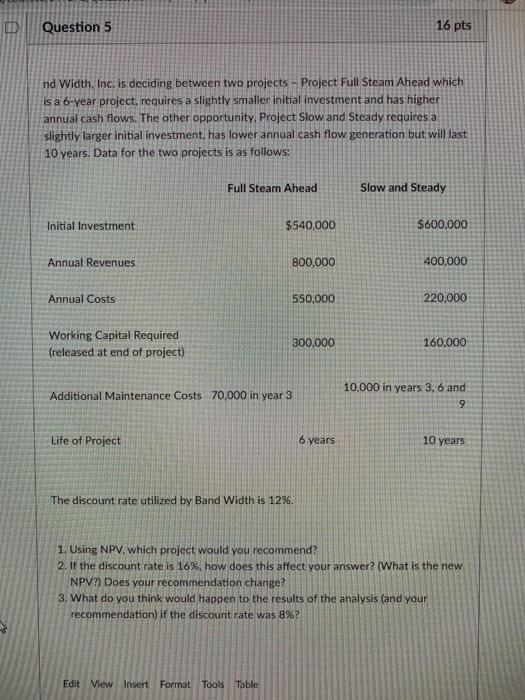

Question: D Question 5 16 pts nd Width, Inc. is deciding between two projects Project Full Steam Ahead which is a 6-year project, requires a slightly

D Question 5 16 pts nd Width, Inc. is deciding between two projects Project Full Steam Ahead which is a 6-year project, requires a slightly smaller initial investment and has higher annual cash flows. The other opportunity Project Slow and Steady requires a slightly larger initial investment, has lower annual cash flow generation but will last 10 years. Data for the two projects is as follows: Full Steam Ahead Slow and Steady Initial Investment $540,000 $600.000 Annual Revenues 800,000 400,000 Annual Costs 550,000 220,000 Working Capital Required (released at end of project) 300.000 160.000 Additional Maintenance Costs 70,000 in year 3 10,000 in years 3, 6 and 9 Life of Project 6 years 10 years The discount rate utilized by Band Width is 12%. 1. Using NPV, which project would you recommend? 2. If the discount rate is 16%, how does this affect your answer? (What is the new NPV?) Does your recommendation change? 3. What do you think would happen to the results of the analysis (and your recommendation) if the discount rate was 8%? Edit View Insert Format Tools Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts