Question: D Question 5 3 pts Management is considering a number of expansion and diversification opportunities in the current budget cycle. Each option requires significant upfront

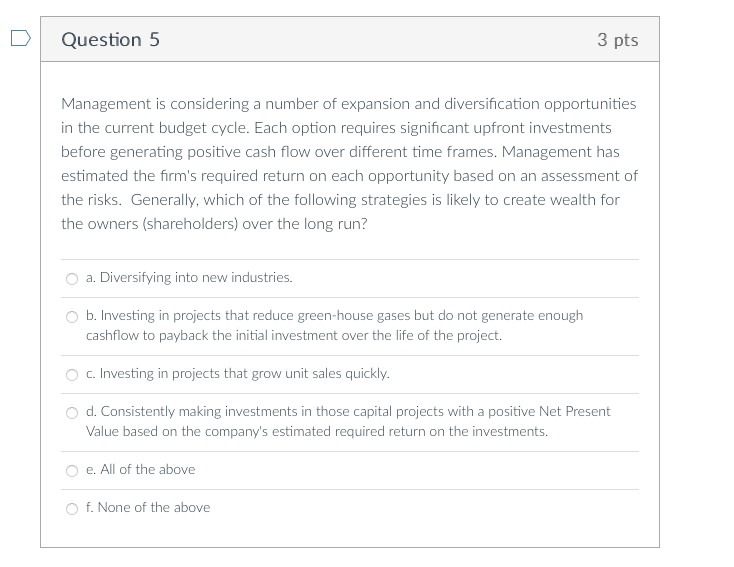

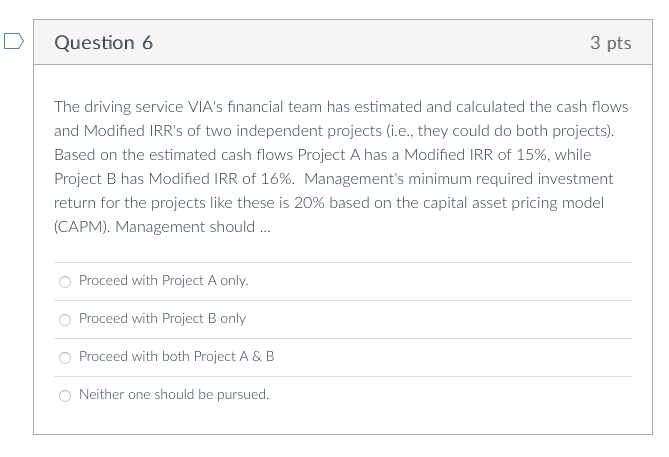

D Question 5 3 pts Management is considering a number of expansion and diversification opportunities in the current budget cycle. Each option requires significant upfront investments before generating positive cash flow over different time frames. Management has estimated the firm's required return on each opportunity based on an assessment of the risks. Generally, which of the following strategies is likely to create wealth for the owners (shareholders) over the long run? a. Diversifying into new industries. b. Investing in projects that reduce green-house gases but do not generate enough cashflow to payback the initial investment over the life of the project. C. Investing in projects that grow unit sales quickly. O d. Consistently making investments in those capital projects with a positive Net Present Value based on the company's estimated required return on the investments. e. All of the above f. None of the above D Question 6 3 pts The driving service VIA's financial team has estimated and calculated the cash flows and Modified IRR's of two independent projects (i.e., they could do both projects). Based on the estimated cash flows Project A has a Modified IRR of 15%, while Project B has Modified IRR of 16%. Management's minimum required investment return for the projects like these is 20% based on the capital asset pricing model (CAPM). Management should ... Proceed with Project A only. Proceed with Project B only Proceed with both Project A & B O Neither one should be pursued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts