Question: D Question 6 1 pts A strangle has two break-even points. The lower break-even point is the underlying price at which the put option's value

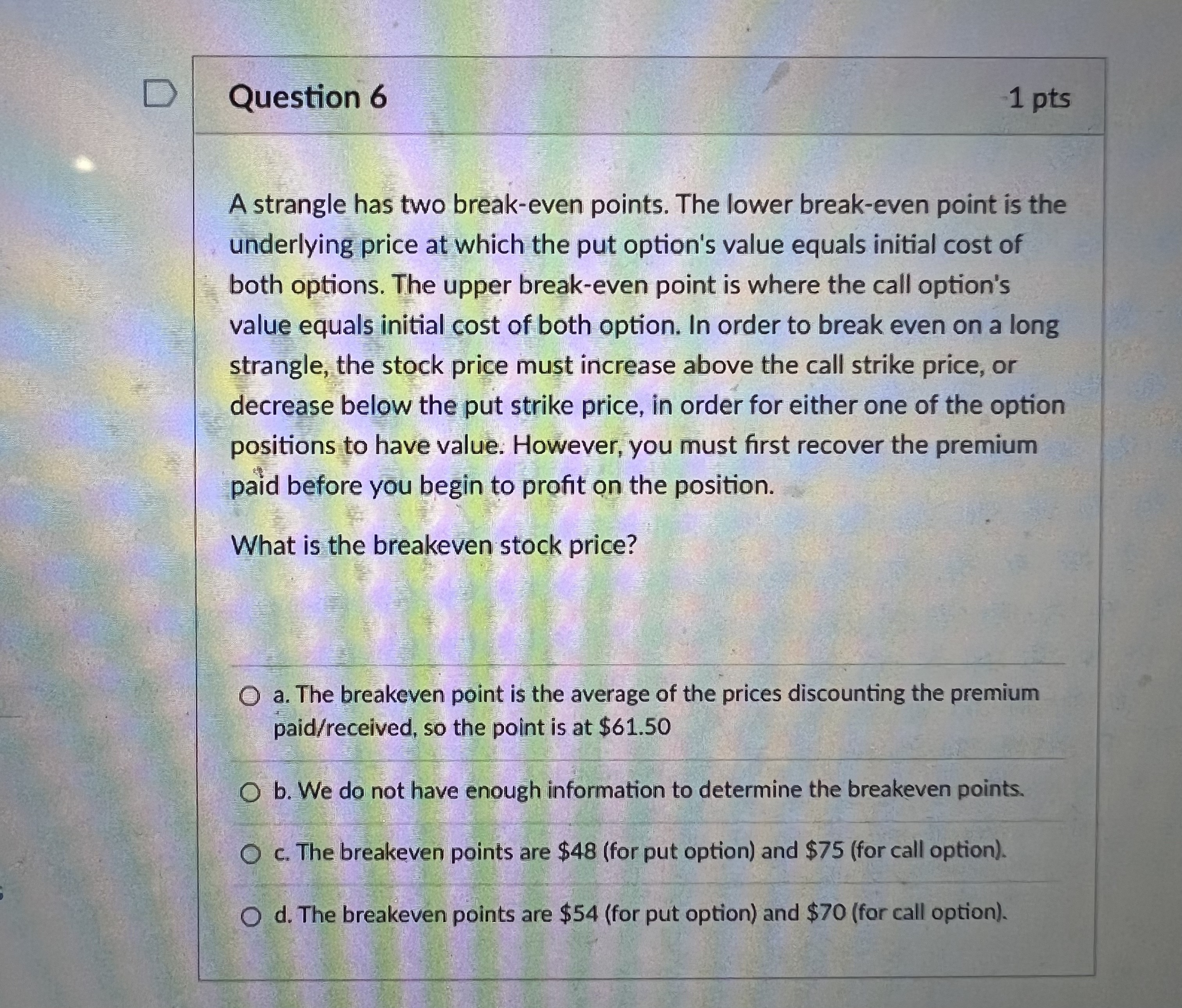

D Question 6 1 pts A strangle has two break-even points. The lower break-even point is the underlying price at which the put option's value equals initial cost of both options. The upper break-even point is where the call option's value equals initial cost of both option. In order to break even on a long strangle, the stock price must increase above the call strike price, or decrease below the put strike price, in order for either one of the option positions to have value. However, you must first recover the premium paid before you begin to profit on the position. What is the breakeven stock price? O a. The breakeven point is the average of the prices discounting the premium paid/received, so the point is at $61.50 O b. We do not have enough information to determine the breakeven points. O c. The breakeven points are $48 (for put option) and $75 (for call option). O d. The breakeven points are $54 (for put option) and $70 (for call option)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts