Question: D Question 6 12 pts For a proposed bridge project, FDOT has estimated the capital investment, annual O&M cost, net annual benefit, and salvage value

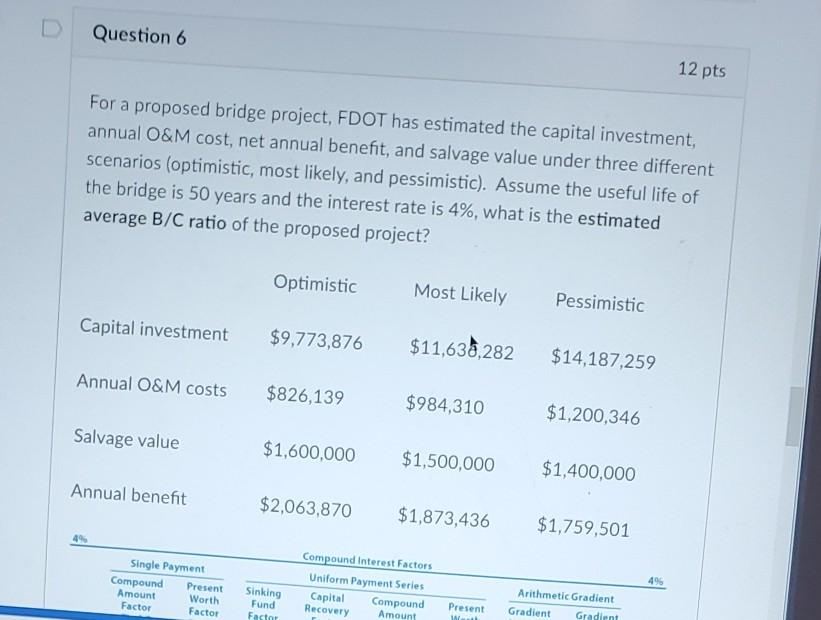

D Question 6 12 pts For a proposed bridge project, FDOT has estimated the capital investment, annual O&M cost, net annual benefit, and salvage value under three different scenarios (optimistic, most likely, and pessimistic). Assume the useful life of the bridge is 50 years and the interest rate is 4%, what is the estimated average B/C ratio of the proposed project? Optimistic Most Likely Pessimistic Capital investment $9,773,876 $11,636,282 $14,187,259 Annual O&M costs $826,139 $984,310 $1,200,346 Salvage value $1,600,000 $1,500,000 $1,400,000 Annual benefit $2,063,870 $1,873,436 $1,759,501 Single Payment Compound Present Amount Worth Factor Factor Compound Interest Factors Uniform Payment Series Capital Compound Recovery Amount 49 Sinking Fund Factor Present W Arithmetic Gradient Gradient Gradient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts