Question: D Question 7 1 pts XYZ Corp has trailing 12 months EBITDA of $202 million. Assume ABC Corp is truly comparable; ABC trades at 9

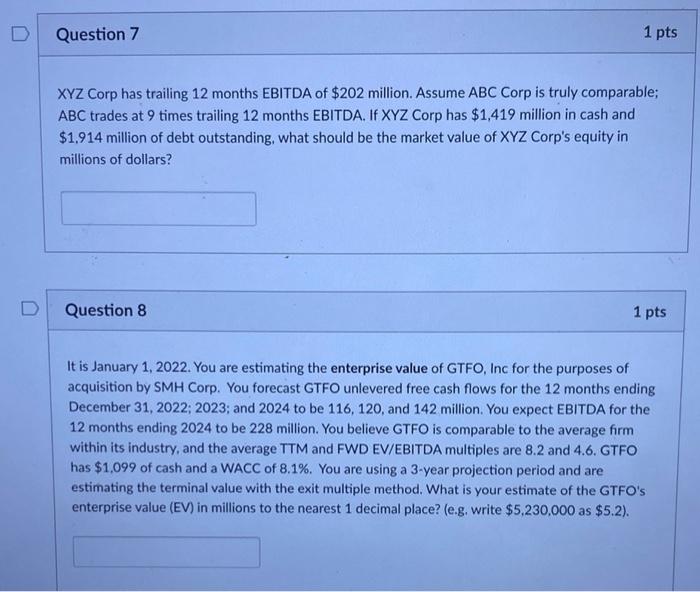

D Question 7 1 pts XYZ Corp has trailing 12 months EBITDA of $202 million. Assume ABC Corp is truly comparable; ABC trades at 9 times trailing 12 months EBITDA. If XYZ Corp has $1,419 million in cash and $1,914 million of debt outstanding, what should be the market value of XYZ Corp's equity in millions of dollars? D Question 8 1 pts It is January 1, 2022. You are estimating the enterprise value of GTFO, Inc for the purposes of acquisition by SMH Corp. You forecast GTFO unlevered free cash flows for the 12 months ending December 31, 2022 2023; and 2024 to be 116, 120, and 142 million. You expect EBITDA for the 12 months ending 2024 to be 228 million. You believe GTFO is comparable to the average form within its industry, and the average TTM and FWD EV/EBITDA multiples are 8.2 and 4.6. GTFO has $1,099 of cash and a WACC of 8.1%. You are using a 3-year projection period and are estimating the terminal value with the exit multiple method. What is your estimate of the GTFO's enterprise value (EV) in millions to the nearest 1 decimal place? (e.g, write $5,230,000 as $5.2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts