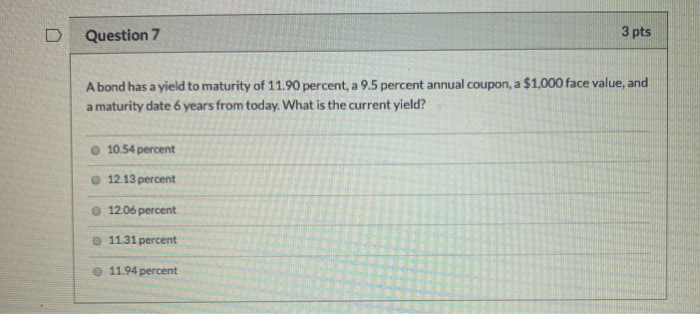

Question: D Question 7 3 pts A bond has a yield to maturity of 11.90 percent, a 9.5 percent annual coupon, a $1,000 face value, and

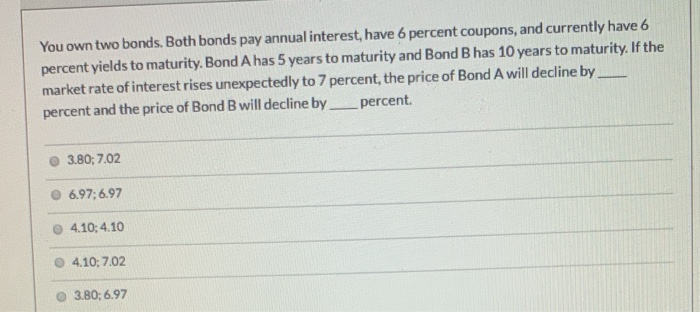

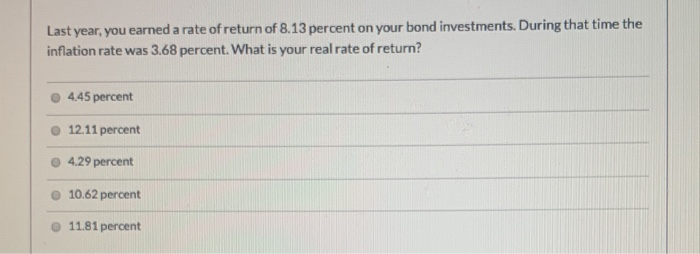

D Question 7 3 pts A bond has a yield to maturity of 11.90 percent, a 9.5 percent annual coupon, a $1,000 face value, and a maturity date 6 years from today. What is the current yield? 10.54 percent 12.13 percent 12.06 percent 11.31 percent 11.94 percent You own two bonds. Both bonds pay annual interest, have 6 percent coupons, and currently have 6 percent yields to maturity. Bond A has 5 years to maturity and Bond B has 10 years to maturity. If the market rate of interest rises unexpectedly to 7 percent, the price of Bond A will decline by percent and the price of Bond B will decline by percent 3.80; 7.02 6.97; 6.97 4.10;4.10 4.10: 7.02 3.80:6.97 Last year, you earned a rate of return of 8.13 percent on your bond investments. During that time the inflation rate was 3.68 percent. What is your real rate of return? 4.45 percent 12.11 percent 4.29 percent 10.62 percent 11.81 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts