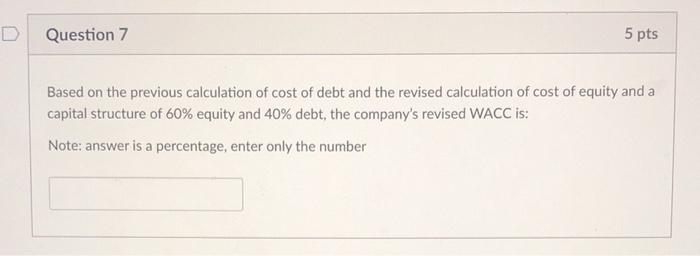

Question: D Question 7 5 pts Based on the previous calculation of cost of debt and the revised calculation of cost of equity and a capital

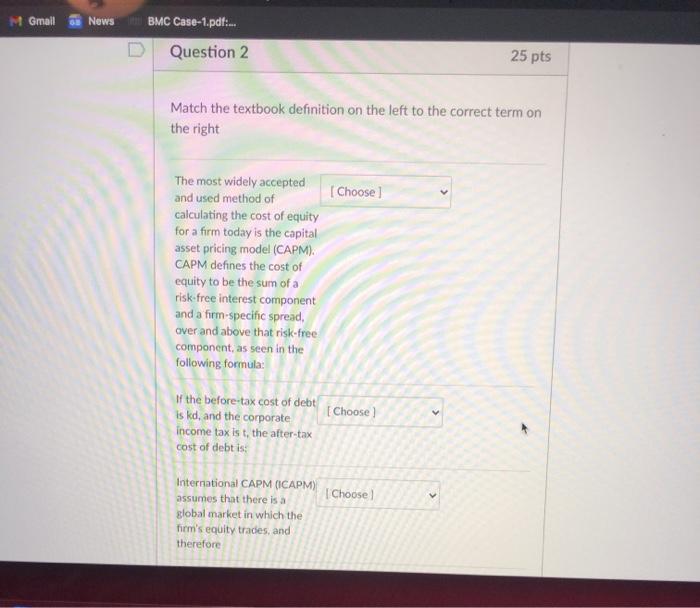

D Question 7 5 pts Based on the previous calculation of cost of debt and the revised calculation of cost of equity and a capital structure of 60% equity and 40% debt, the company's revised WACC is: Note: answer is a percentage, enter only the number M Gmall News BMC Case-1.pdf:.. Question 2 25 pts Match the textbook definition on the left to the correct term on the right Choose The most widely accepted and used method of calculating the cost of equity for a firm today is the capital asset pricing model (CAPM). CAPM defines the cost of equity to be the sum of a risk-free interest component and a firm-specific spread, over and above that risk-free component, as seen in the following formula: [Choose if the before tax cost of debt is kd, and the corporate income tax is t, the after tax cost of debt is: [Choose International CAPM (ICAPM) assumes that there is a global market in which the firm's equity trades, and therefore D Question 7 5 pts Based on the previous calculation of cost of debt and the revised calculation of cost of equity and a capital structure of 60% equity and 40% debt, the company's revised WACC is: Note: answer is a percentage, enter only the number M Gmall News BMC Case-1.pdf:.. Question 2 25 pts Match the textbook definition on the left to the correct term on the right Choose The most widely accepted and used method of calculating the cost of equity for a firm today is the capital asset pricing model (CAPM). CAPM defines the cost of equity to be the sum of a risk-free interest component and a firm-specific spread, over and above that risk-free component, as seen in the following formula: [Choose if the before tax cost of debt is kd, and the corporate income tax is t, the after tax cost of debt is: [Choose International CAPM (ICAPM) assumes that there is a global market in which the firm's equity trades, and therefore

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts