Question: D Question 8 15 pts Almost There, Inc. currently has no debt, but is considering recapitalizing the firm. Specifically, it is planning to issue

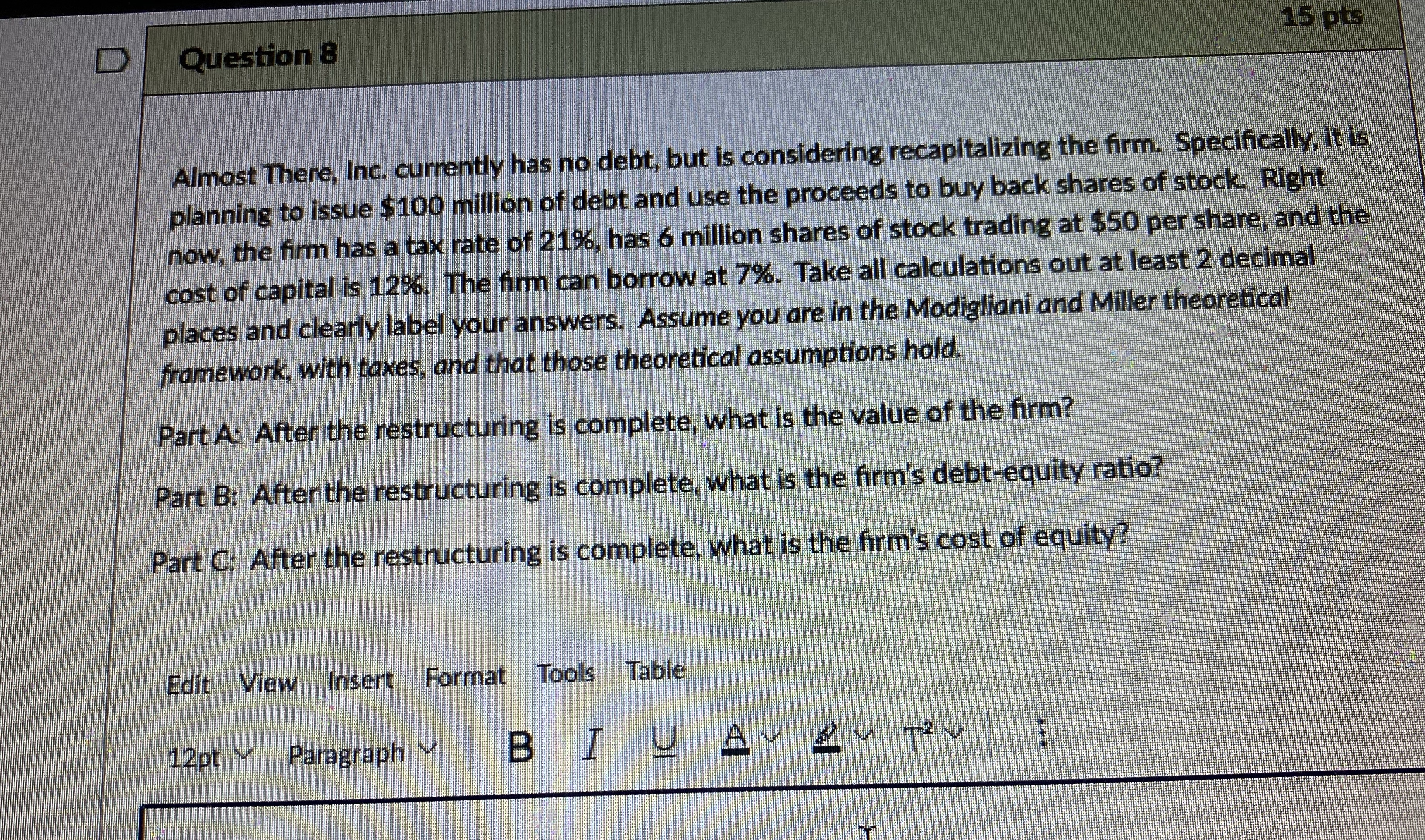

D Question 8 15 pts Almost There, Inc. currently has no debt, but is considering recapitalizing the firm. Specifically, it is planning to issue $100 million of debt and use the proceeds to buy back shares of stock. Right now, the firm has a tax rate of 21%, has 6 million shares of stock trading at $50 per share, and the cost of capital is 12%. The firm can borrow at 7%. Take all calculations out at least 2 decimal places and clearly label your answers. Assume you are in the Modigliani and Miller theoretical framework, with taxes, and that those theoretical assumptions hold. Part A: After the restructuring is complete, what is the value of the firm? Part B: After the restructuring is complete, what is the firm's debt-equity ratio? Part C: After the restructuring is complete, what is the firm's cost of equity? Edit View Insert Format Tools Table 12pt Paragraph V BIU A R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts