Question: D SECTION 4 - Two (2) Problem questions - Each worth 12 marks - Total 24 marks Q1. Burlington Products is a decentralized wholesaler with

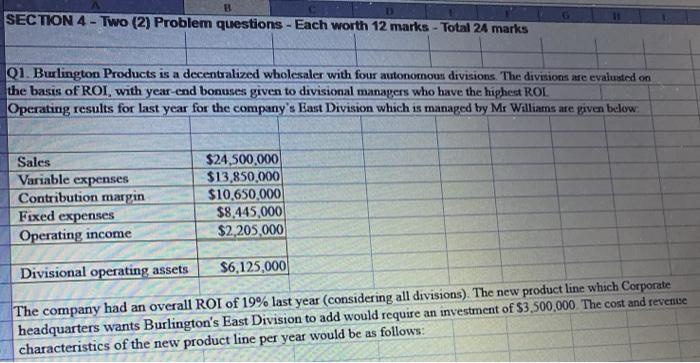

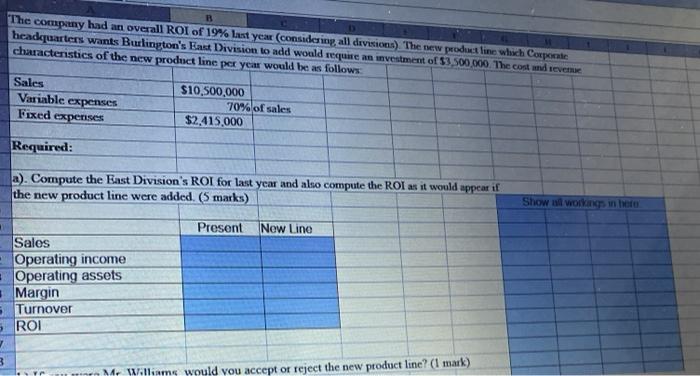

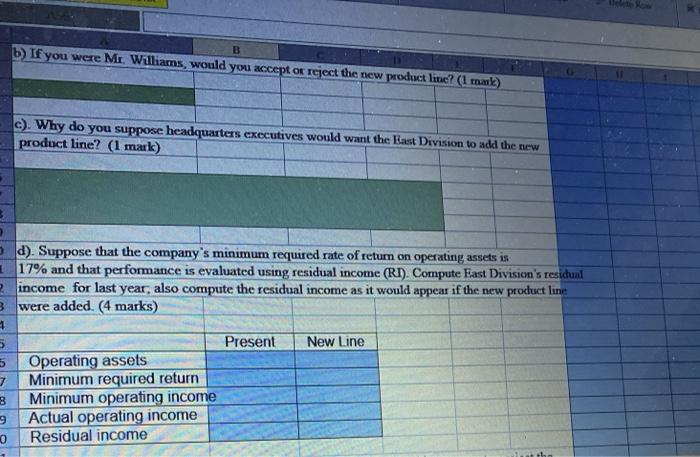

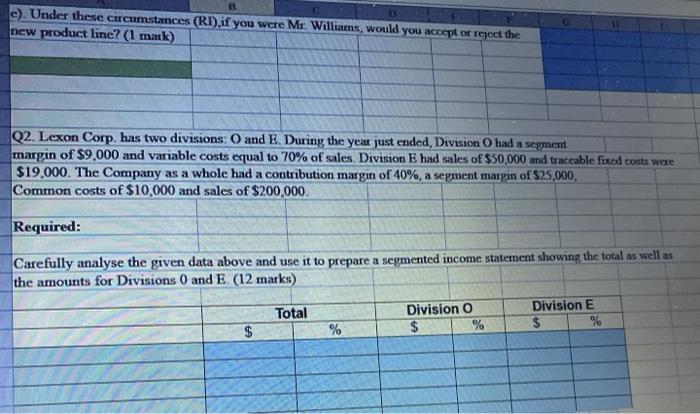

D SECTION 4 - Two (2) Problem questions - Each worth 12 marks - Total 24 marks Q1. Burlington Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to divisional managers who have the highest ROL Operating results for last year for the company's East Division which is managed by Mr Williams are given below Sales Variable expenses Contribution margin Fixed expenses Operating income $24,500,000 $13,850,000 $10,650.000 $8.445,000 $2,205,000 Divisional operating assets $6.125.000 The company had an overall ROI of 19% last year (considering all divisions). The new product line which Corporate headquarters wants Burlington's East Division to add would require an investment of $3,500,000 The cost and revenise characteristics of the new product line per year would be as follows: The company had an overall ROI of 19% last year (considering all divisions) The new product line which Corporate headquarters wants Burlington's East Division to add would require an investment of $3.500.000 The cost and even characteristics of the new product line per year would be as follows Sales Variable expenses Fixed expenses $10.500.000 70% of sales $2.415.000 Required: a) Compute the East Division's ROI for last year and also compute the ROI as it would appear if the new product line were added. (5 marks) Show will win beto Present New Line Sales Operating income Operating assets Margin 5 Turnover 5 ROI 7 3 M. Williams would you accept or reject the new product line? (1 mark) b) If you were Mr. Williams, would you accept or reject the new product line? (1 mark) B c). Why do you suppose headquarters executives would want the East Division to add the new product line? (1 mark) . 3 1 d). Suppose that the company's minimum required rate of return on operating assets is 17% and that performance is evaluated using residual income (RI). Compute East Division's residual income for last year, also compute the residual income as it would appear if the new product line were added. (4 marks) 2 3 1 > New Line 7 8 Present Operating assets Minimum required return Minimum operating income Actual operating income Residual income 0 c). Under these circumstances (RI).if you were Mr Williams, would you accept or reject the new product line? (1 mark) Q2. Lexon Corp. has two divisions: O and E. During the year just ended. Division O had a segment margin of $9,000 and variable costs equal to 70% of sales. Division E had sales of $50,000 and traceable fixed costs were $19,000. The Company as a whole had a contribution margin of 40%, a sepment margin of $25.000, Common costs of $10,000 and sales of $200,000 Required: Carefully analyse the given data above and use it to prepare a segmented income statement showing the total as well as the amounts for Divisions 0 and E. (12 marks) Total Division 0 $ % Division E $ %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts