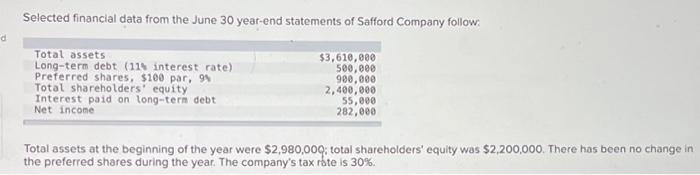

Question: d Selected financial data from the June 30 year-end statements of Safford Company follow: $3,610,000 500,000 900,000 2,400,000 55,000 282,000 Total assets Long-term debt

d Selected financial data from the June 30 year-end statements of Safford Company follow: $3,610,000 500,000 900,000 2,400,000 55,000 282,000 Total assets Long-term debt (11% interest rate) Preferred shares, $100 par, 9% Total shareholders' equity Interest paid on long-term debt Net income Total assets at the beginning of the year were $2,980,000; total shareholders' equity was $2,200,000. There has been no change in the preferred shares during the year. The company's tax rate is 30%. Required: 1. Compute the return on total assets. (Round your answer to 1 decimal place.) 2. Compute the return on common shareholders' equity. (Round your answer to 1 decimal place.)

Step by Step Solution

3.43 Rating (169 Votes )

There are 3 Steps involved in it

1 Return on Total Assets ROTA The Return on Total Assets measures a companys earnings in relation to all of its assets and indicates how efficiently t... View full answer

Get step-by-step solutions from verified subject matter experts