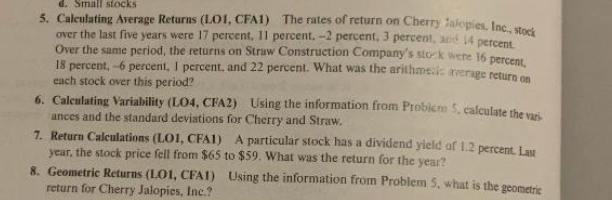

Question: d. Small stocks 5. Calculating Average Returns (LO1, CFA1) The rates of return on Cherry lopies, Inc., Stock over the last five years were 17

d. Small stocks 5. Calculating Average Returns (LO1, CFA1) The rates of return on Cherry lopies, Inc., Stock over the last five years were 17 percent, 11 percent. --2 percent, 3 percent, 200 14 percent Over the same period, the returns on Straw Construction Company's stock were 16 percent, 18 percent . -6 percent. I percent, and 22 percent. What was the arithmeal average return on each stock over this period? 6. Calculating Variability (L04, CFA2) Using the information from Prebicm 5. calculate the vari ances and the standard deviations for Cherry and Straw. 7. Return Calculations (LOI, CFAI) A particular stock has a dividend yield of 1.2 percent. Last year, the stock price fell from $65 to $59. What was the return for the year? 8. Geometric Returns (L01, CFA1) Using the information from Problem 5, what is the geometrie return for Cherry Jalopies, Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts