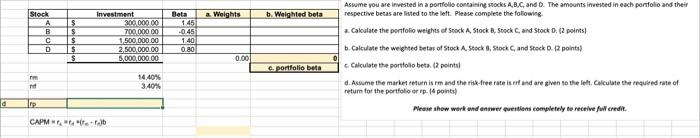

Question: d Stock Investment A $ B $ C $ D $ $ rm- nd CAPM)b 300.000.00 700,000.00 1,500,000.00 2,500,000.00 5,000,000.00 14.40% 3.40% Beta 1.45 -0.45

d Stock Investment A $ B $ C $ D $ $ rm- nd CAPM)b 300.000.00 700,000.00 1,500,000.00 2,500,000.00 5,000,000.00 14.40% 3.40% Beta 1.45 -0.45 1.40 0.80 a Weights 0.00 b. Weighted beta c. portfolio beta Assume you are invested in a portfolio containing stocks A,B,C, and D. The amounts invested in each portfolio and their respective betas are listed to the left. Please complete the following. a. Calculate the portfolio weights of Stock A, Stock B, Stock C, and Stock D. (2 points) b. Calculate the weighted betas of Stock A, Stock 8, Stock C, and Stock D. (2 points) c. Calculate the portfoliobeta. (2 points) d. Assume the market return is rm and the risk-free rate is rrf and are given to the left. Calculate the required rate of return for the portfolio or rp. (4 points) Please show work and answer questions completely to receive full credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts