Question: D. Tax Brackets. The U.S. has a progressive tax system, meaning the more income you higher tax rate you pay. Use the tax table

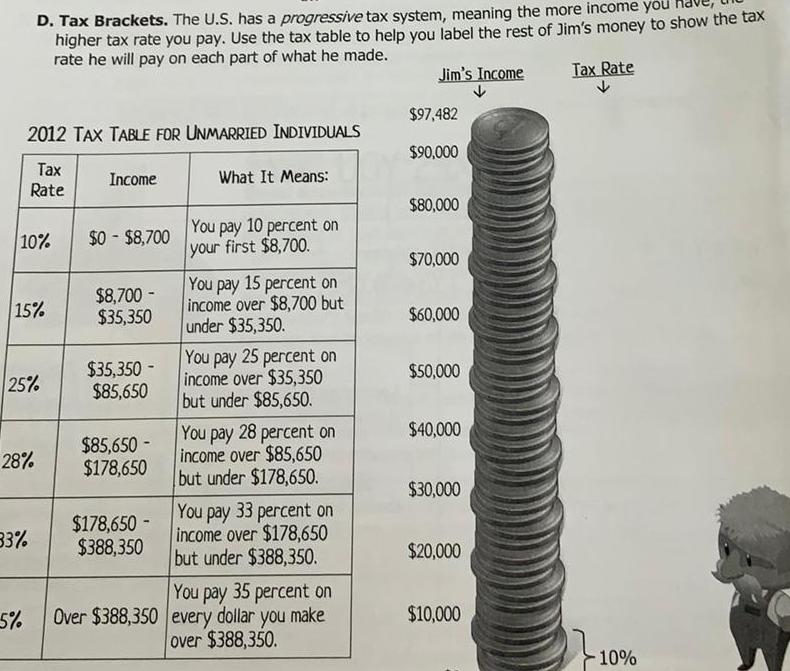

D. Tax Brackets. The U.S. has a progressive tax system, meaning the more income you higher tax rate you pay. Use the tax table to help you label the rest of Jim's money to show the tax rate he will pay on each part of what he made. Jim's Income Tax Rate $97,482 2012 TAX TABLE FOR UNMARRIED INDIVIDUALS $90,000 Tax Income What It Means: Rate $80,000 10% $0-$8,700 You pay 10 percent on your first $8,700. $70,000 $8,700- You pay 15 percent on 15% income over $8,700 but $35,350 $60,000 under $35,350. $35,350- You pay 25 percent on 25% income over $35,350 $50,000 $85,650 but under $85,650. $85,650 - You pay 28 percent on $40,000 28% income over $85,650 $178,650 but under $178,650. $30,000 $178,650 - You pay 33 percent on 83% income over $178,650 $388,350 but under $388,350. $20,000 You pay 35 percent on 5% Over $388,350 every dollar you make over $388,350. $10,000 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts