Question: d ) Think about changes in a project once it has been accepted and moving forward. Here are 3 potential scenarios. For each, assume everything

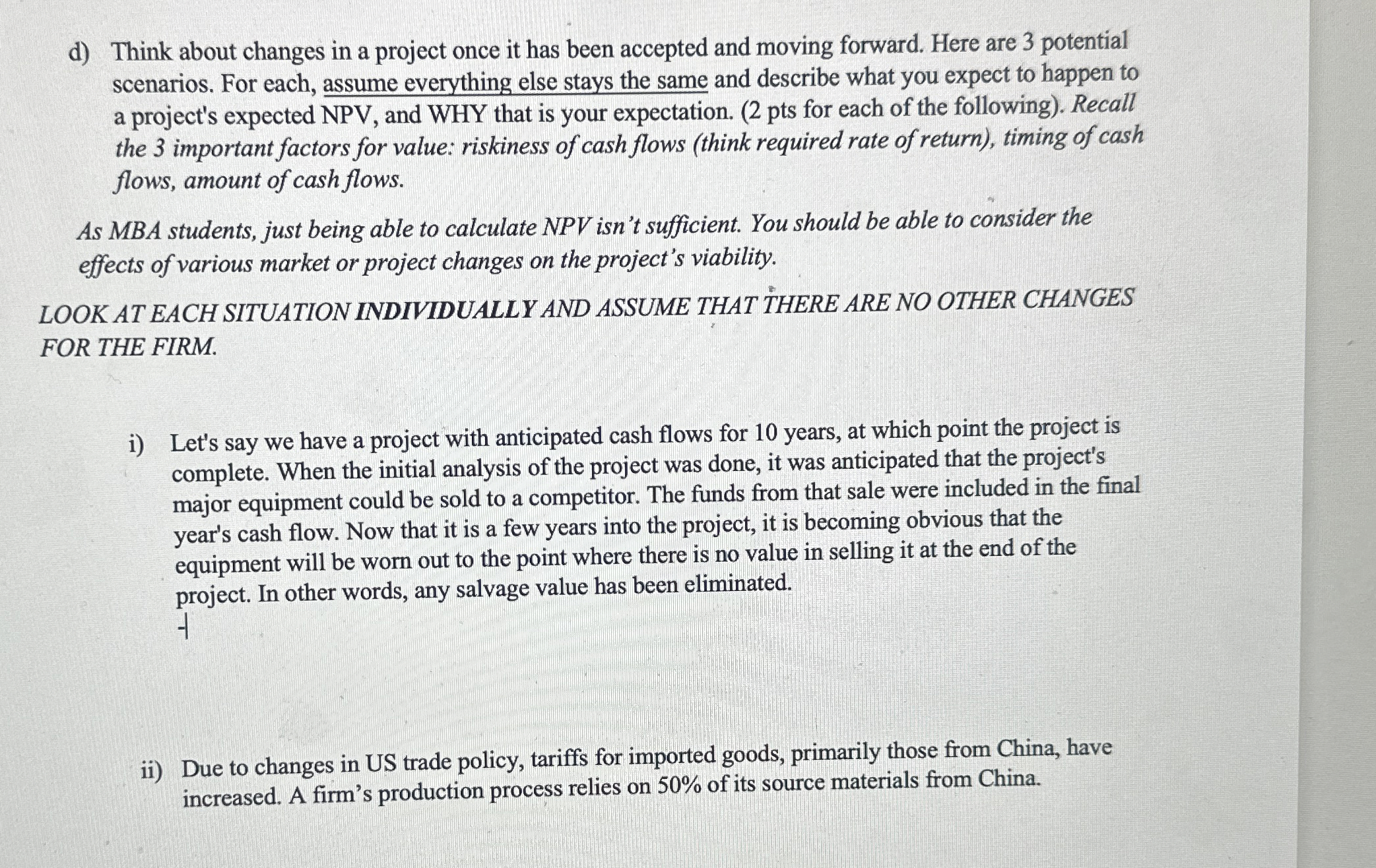

d Think about changes in a project once it has been accepted and moving forward. Here are potential

scenarios. For each, assume everything else stays the same and describe what you expect to happen to

a project's expected NPV and WHY that is your expectation. pts for each of the following Recall

the important factors for value: riskiness of cash flows think required rate of return timing of cash

flows, amount of cash flows.

As MBA students, just being able to calculate NPV isn't sufficient. You should be able to consider the

effects of various market or project changes on the project's viability.

LOOK AT EACH SITUATION INDIVIDUALLY AND ASSUME THAT THERE ARE NO OTHER CHANGES

FOR THE FIRM.

i Let's say we have a project with anticipated cash flows for years, at which point the project is

complete. When the initial analysis of the project was done, it was anticipated that the project's

major equipment could be sold to a competitor. The funds from that sale were included in the final

year's cash flow. Now that it is a few years into the project, it is becoming obvious that the

equipment will be worn out to the point where there is no value in selling it at the end of the

project. In other words, any salvage value has been eliminated.

ii Due to changes in US trade policy, tariffs for imported goods, primarily those from China, have

increased. A firm's production process relies on of its source materials from China.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock