Question: d . This is the entire question I need help with it is the managerial accounting 7th edition, problem 12-10a the following questions are whaht

d

.

This is the entire question I need help with it is the managerial accounting 7th edition, problem 12-10a the following questions are whaht I need help with, I have re written the questions for better visual.

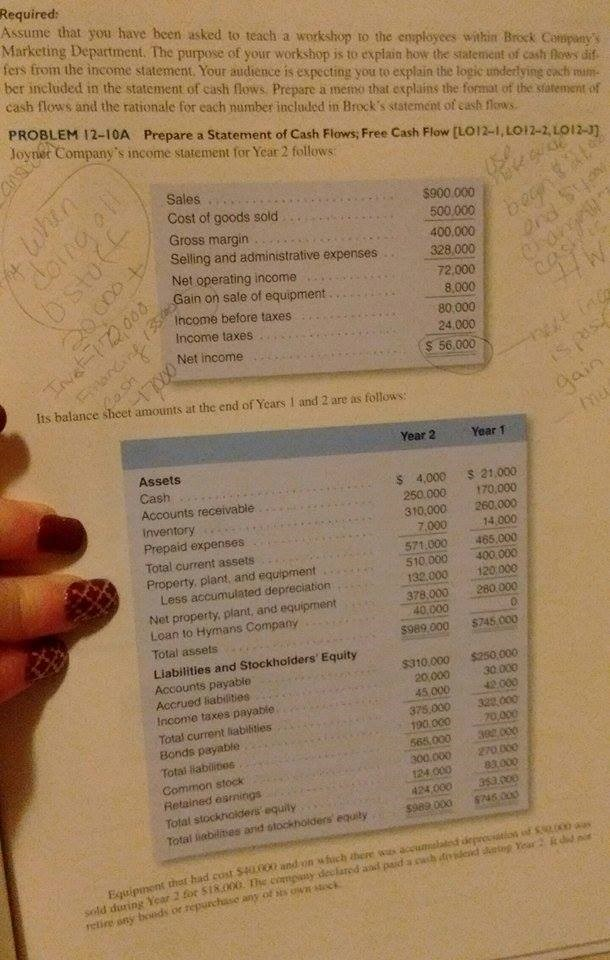

You have been asked to teach a workshop at your company the Brock company to explain how the statement of cash flow differs from an income statement Your audience is expecting you to explain logic underlying each number included in the statement of cash flows. Prepare a memo that explains format of the statement of cash flow and the rationale for each number included in statement of cashflow from the Brock company

1. using the indirect method compute the net cash provided by operating activities for year 2

2. prepare the statement of cash flows for year 2,

3.compute the free cash flow for year two

4. briefly explain why the cash declined so sharply during the year

Additional info that is blurry

Equiptment that had cost $40,000 on which there was accumalated depreciation of $30,000 was sold during year 2 for $18,000. The company declared and paid a cash dividend during year 2. It did not retire any bonds or repurchase any of its own stock.

Required: Assume that you have been asked to teach a workshop ro the cmployees within Brock Caferunys Marketing Department. The purpose of your workshop isto explain how the sialement of cash nows dif fers from the income statement. Your audience is expecting you to explain the logic underlying each ber included in the statement of cash flows Prepare a memo that explains the format of the statement of cash flows and the rationale for each number included in Brock's statement of eash flows PROBLEM 12-10A Prepare a statement of cash Flows Free cash Flow tuo12-1,Lot2-2,Lo12-n joyner Company's income statement for Year 2 follows Sales 500,000 Cost of goods sold Gross margin 328,000 Selling and administrative expenses 72,000 Net operating income Gain on sale of equipment ncome before taxes 24,000 Income taxes 56,000 Net income lts balance sheet amounts at the end of Years l and 2 are as follows: Year 1 Year 2 s 21.000 Assets 250.000 170,000 Cash 310,000 260.000 Accounts receivable 14,000 inventory 465,000 Prepaid expenses 571.000 510,000 400 000 Total current assets Property, plant and equipment Less accumulated depreciation 378 000 280 000 Net property, plant, and equipment Loan to Hymans Company Total assets Stockholders' Equity Liabilities and s310,000 $250 000 20 000 30 000 Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable 300,000 270 000 Total liabilities 424,000 393,200 Retained earnings sse 000 NS Total liabilites and otockholders equity that had cost $4 u and mn there pasud a 0tX The comp declared and sold during Year 2 any of own breads or repurchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts