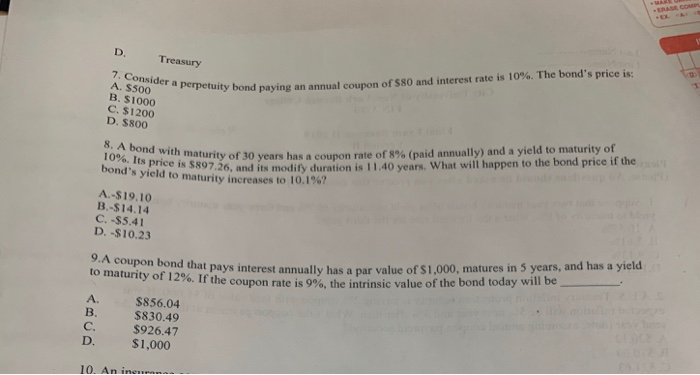

Question: D. Treasury 7. Consider a perpetuity Pefuity bond paying an annual coupon of $80 and interest rate is 10%. The bond's price is: A. S500

D. Treasury 7. Consider a perpetuity "Pefuity bond paying an annual coupon of $80 and interest rate is 10%. The bond's price is: A. S500 B. S1000 C. $1200 D. 5800 8. A bond with maturity of 30 ye 10%. Its price is $897.26, an bond's yield to maturity increases to 10.1967 naturity of 30 years has a coupon rate of 8% (paid annually) and a yield to maturity of S $897.26, and its modify duration is 11.40 years. What will happen to the bond price if the A.-$19.10 B.-$14.14 C.-95.41 D. -$10.23 9. A coupon bond that pays interest annually has a par to maturity of 12%. If the coupon rate is 9%, the intrinsic at pays interest annually has a par value of $1.000, matures in 5 years, and has a yield If the coupon rate is 9%, the intrinsic value of the bond today will be B. $856.04 $830.49 $926.47 $1,000 D. 10. An ineum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts