Question: (d) Two identical firms engaging in identical projects differ in their level of debt. A has no debt and B has debt of $10,000

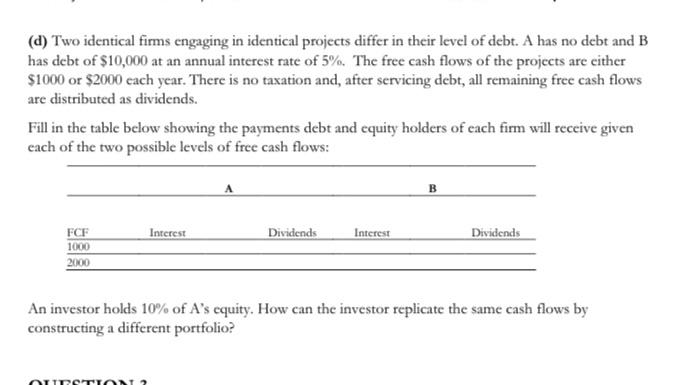

(d) Two identical firms engaging in identical projects differ in their level of debt. A has no debt and B has debt of $10,000 at an annual interest rate of 5%. The free cash flows of the projects are either $1000 or $2000 each year. There is no taxation and, after servicing debt, all remaining free cash flows are distributed as dividends. Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows: FCF 1000 2000 Interest QUESTION ? A Dividends Interest B Dividends An investor holds 10% of A's equity. How can the investor replicate the same cash flows by constructing a different portfolio?

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Lets first calculate the interest payment that firm B needs to make each year on its debt of 10000 a... View full answer

Get step-by-step solutions from verified subject matter experts