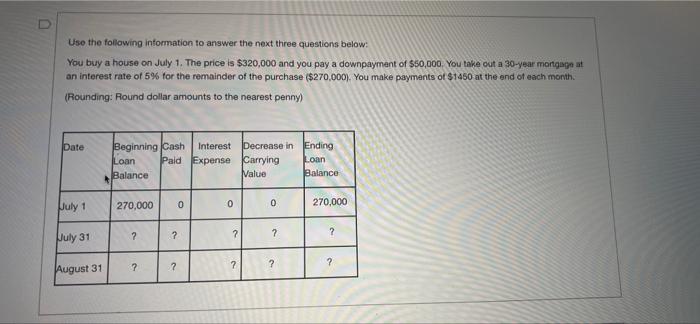

Question: D Use the following information to answer the next three questions below: You buy a house on July 1. The price is $320,000 and you

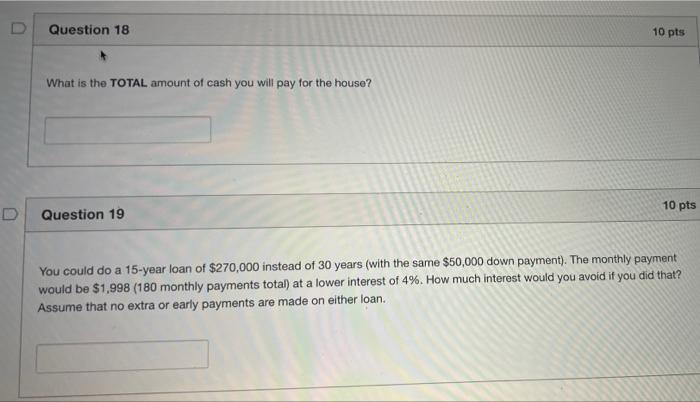

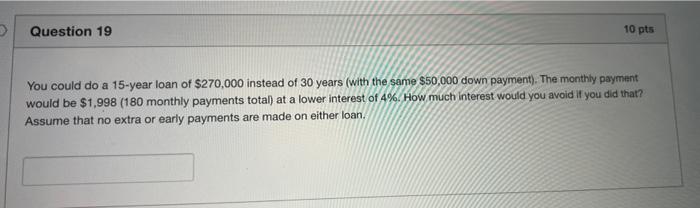

D Use the following information to answer the next three questions below: You buy a house on July 1. The price is $320,000 and you pay a downpayment of $50,000 You take out a 30-year mortgage at an interest rate of 5% for the remainder of the purchase ($270,000). You make payments of $1450 at the end of each month. (Rounding: Round dollar amounts to the nearest penny) Date Beginning Cash Interest Decrease in Ending Loan Pald Expense Carrying Loan Balance Nalue Balance 270,000 July 1 0 0 0 270,000 2 ? ? July 31 7 2 7 ? ? ? August 31 Question 18 10 pts What is the TOTAL amount of cash you will pay for the house? 10 pts D Question 19 You could do a 15-year loan of $270,000 instead of 30 years (with the same $50,000 down payment). The monthly payment would be $1,998 (180 monthly payments total) at a lower interest of 4%. How much interest would you avoid if you did that? Assume that no extra or early payments are made on either loan. Question 19 10 pts You could do a 15-year loan of $270,000 instead of 30 years (with the same $50,000 down payment). The monthly payment would be $1,998 (180 monthly payments total) at a lower interest of 4%. How much interest would you avoid if you did that? Assume that no extra or early payments are made on either loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts