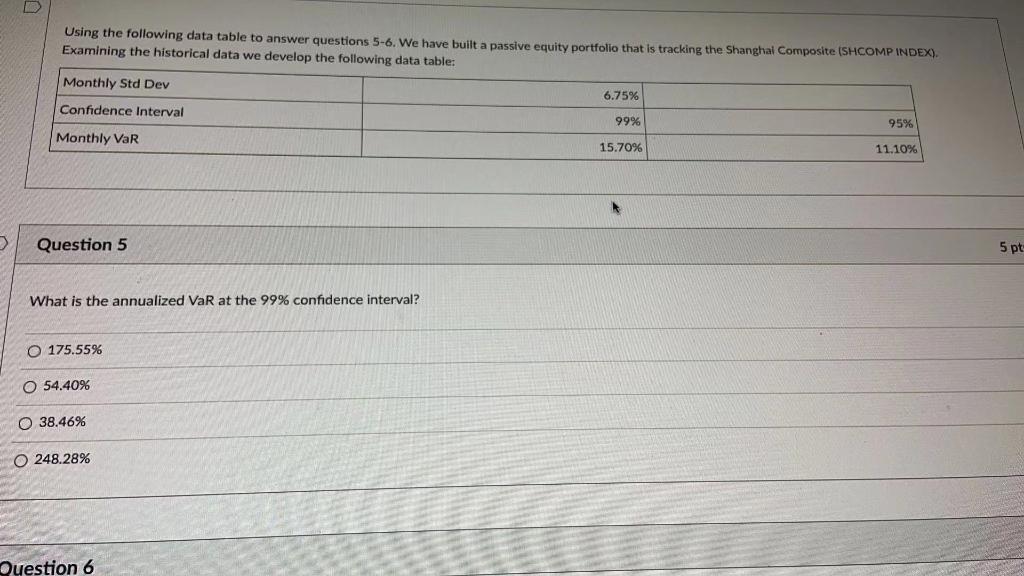

Question: D Using the following data table to answer questions 5-6. We have built a passive equity portfolio that is tracking the Shanghal Composite (SHCOMP INDEX).

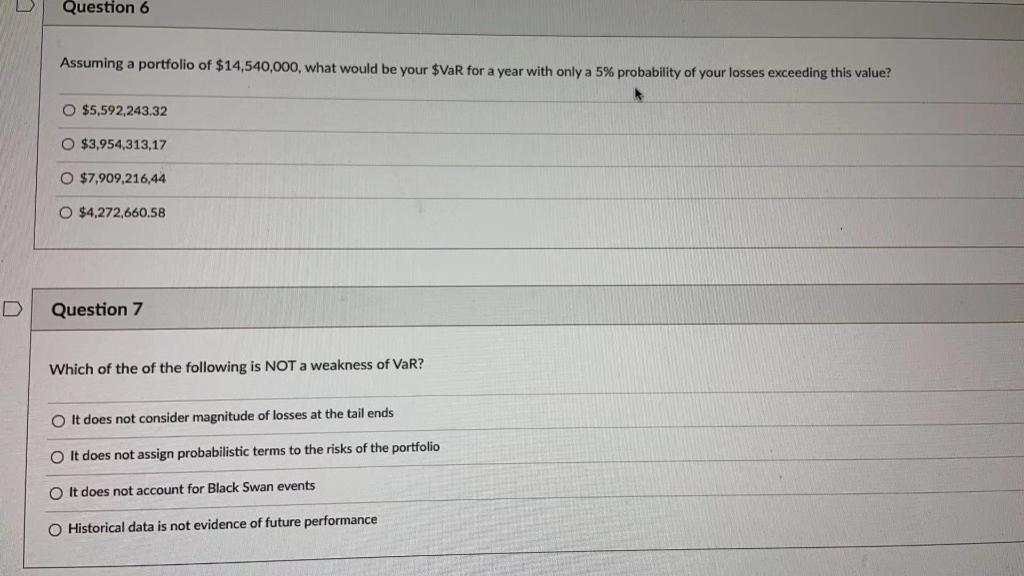

D Using the following data table to answer questions 5-6. We have built a passive equity portfolio that is tracking the Shanghal Composite (SHCOMP INDEX). Examining the historical data we develop the following data table: Monthly Std Dev 6.75% Confidence Interval 99% 95% Monthly VaR 15.70% 11.10% Question 5 5pt What is the annualized VaR at the 99% confidence interval? O 175.55% O 54.40% 38.46% O 248.28% Question 6 Question 6 Assuming a portfolio of $14,540,000, what would be your $VaR for a year with only a 5% probability of your losses exceeding this value? O $5,592,243.32 O $3,954,313,17 O $7,909,216,44 O $4,272,660.58 Question 7 Which of the of the following is NOT a weakness of Var? O It does not consider magnitude of losses at the tail ends O It does not assign probabilistic terms to the risks of the portfolio O It does not account for Black Swan events O Historical data is not evidence of future performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts