Question: (d) What does return on equity (ROE) measure? Calculate the ROE for both Oakhurst Bank and Portola Savings and Loan if the return on assets

(d) What does return on equity (ROE) measure? Calculate the ROE for both Oakhurst Bank and Portola Savings and Loan if the return on assets (ROA) is equal to 0.2% for both banks. What is the downside for Portola Savingsand Loan in having more bank capital? [4 Points]

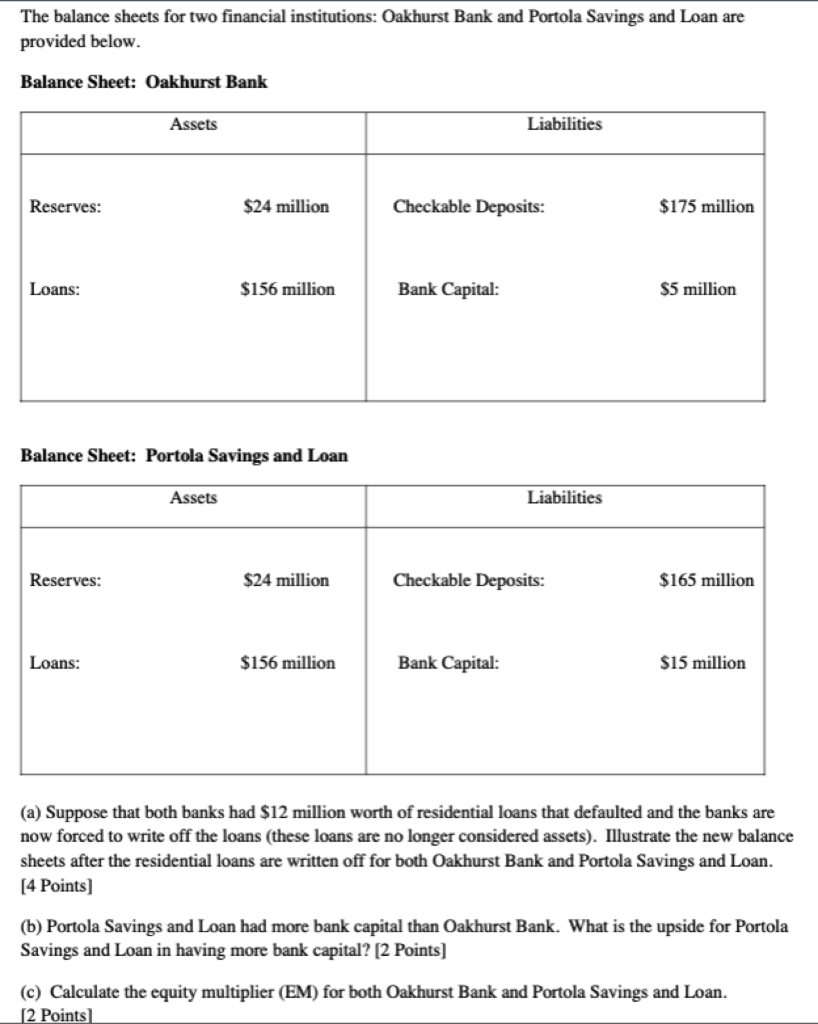

The balance sheets for two financial institutions: Oakhurst Bank and Portola Savings and Loan are provided below. Balance Sheet: Oakhurst Bank Assets Liabilities Reserves: $24 million Checkable Deposits: $175 million Loans: $156 million Bank Capital: $5 million Balance Sheet: Portola Savings and Loan Assets Liabilities Reserves: $24 million Checkable Deposits: $165 million Loans: $156 million Bank Capital: $15 million (a) Suppose that both banks had $12 million worth of residential loans that defaulted and the banks are now forced to write off the loans (these loans are no longer considered assets). Illustrate the new balance sheets after the residential loans are written off for both Oakhurst Bank and Portola Savings and Loan. [4 Points) (b) Portola Savings and Loan had more bank capital than Oakhurst Bank. What is the upside for Portola Savings and Loan in having more bank capital? [2 Points) (c) Calculate the equity multiplier (EM) for both Oakhurst Bank and Portola Savings and Loan. 2 Points The balance sheets for two financial institutions: Oakhurst Bank and Portola Savings and Loan are provided below. Balance Sheet: Oakhurst Bank Assets Liabilities Reserves: $24 million Checkable Deposits: $175 million Loans: $156 million Bank Capital: $5 million Balance Sheet: Portola Savings and Loan Assets Liabilities Reserves: $24 million Checkable Deposits: $165 million Loans: $156 million Bank Capital: $15 million (a) Suppose that both banks had $12 million worth of residential loans that defaulted and the banks are now forced to write off the loans (these loans are no longer considered assets). Illustrate the new balance sheets after the residential loans are written off for both Oakhurst Bank and Portola Savings and Loan. [4 Points) (b) Portola Savings and Loan had more bank capital than Oakhurst Bank. What is the upside for Portola Savings and Loan in having more bank capital? [2 Points) (c) Calculate the equity multiplier (EM) for both Oakhurst Bank and Portola Savings and Loan. 2 Points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts