Question: d) What is the expected amount Jon will actually use from his FSA, if he chooses the maximum contribution $2,550? What is the expected remaining

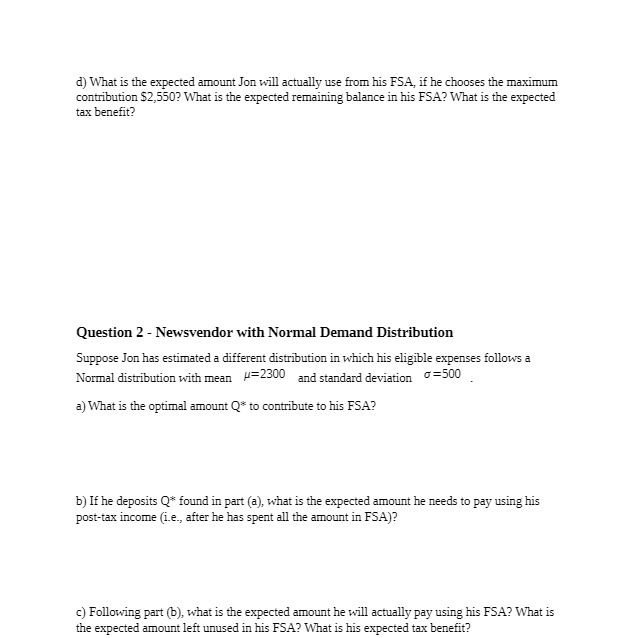

d) What is the expected amount Jon will actually use from his FSA, if he chooses the maximum contribution $2,550? What is the expected remaining balance in his FSA? What is the expected tax benefit? Question 2 - Newsvendor with Normal Demand Distribution Suppose Jon has estimated a different distribution in which his eligible expenses follows a Normal distribution with mean =2500 and standard deviation =500 a) What is the optimal amount Q* to contribute to his FSA? b) If he deposits Q* found in part (a), what is the expected amount he needs to pay using his post-tax income (i.e., after he has spent all the amount in FSA)? c) Following part (b), what is the expected amount he will actually pay using his FSA? What is the expected amount left unused in his FSA? What is his expected tax benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts