Question: d. What metric would you pick to do a direct valuation for Mastec? Why did you choose that metric? What value would you pick for

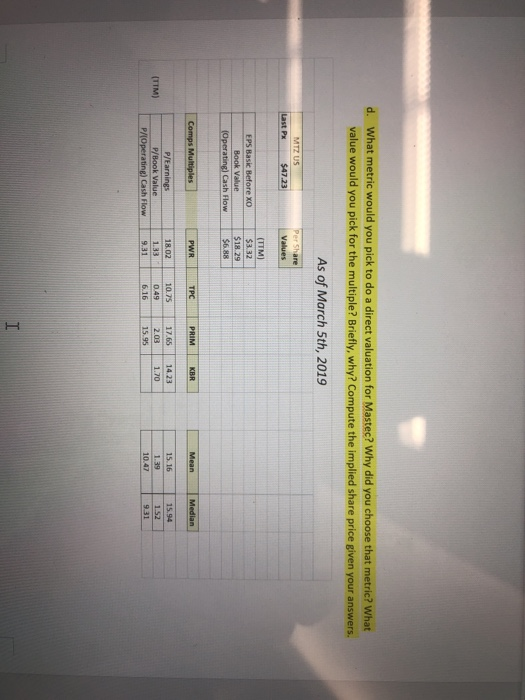

d. What metric would you pick to do a direct valuation for Mastec? Why did you choose that metric? What value would you pick for the multiple? Briefly, why? Compute the implied share price given your answers. As of March 5th, 2019 Last Px $47.23 Per Share Values (TIM) $3.32 EPS Basic Before xo Book Value Operating Cash How Comps Multiples PWR TPC PRIMI KBR Mean Median 1 14.23 (TTM) P/Earnings P/Book Value P/Operating) Cash Flow 18.02 1.33 9.31 0.75 0.49 .16 17.65 2.03 1 5.95 6 931

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock