Question: d) Which strategy, ETFs or futures, has the higher expected return if the investor is unwilling to accept credit risk? You will need to

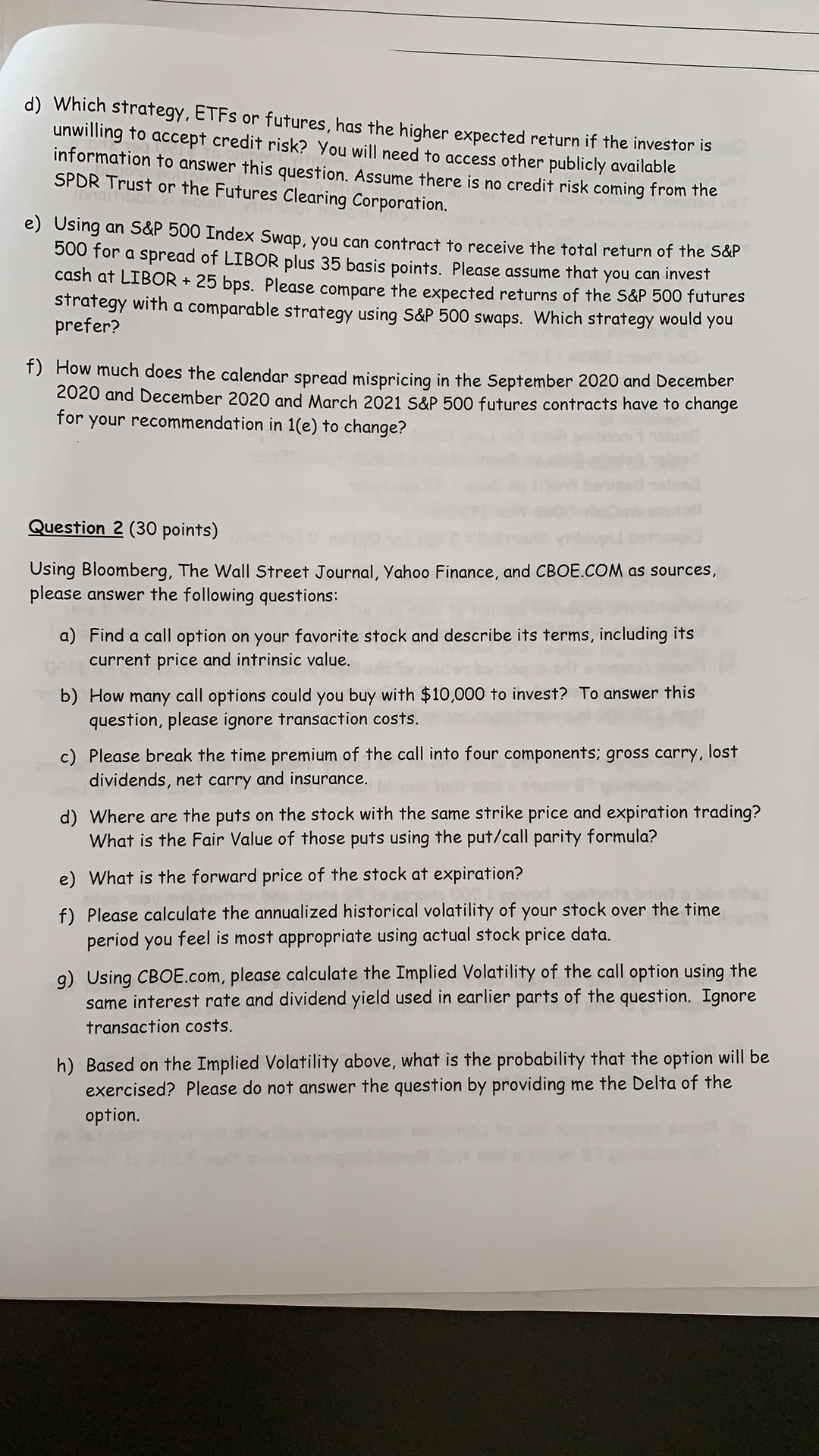

d) Which strategy, ETFs or futures, has the higher expected return if the investor is unwilling to accept credit risk? You will need to access other publicly available information to answer this question. Assume there is no credit risk coming from the SPDR Trust or the Futures Clearing Corporation. e) Using an S&P 500 Index Swap, you can contract to receive the total return of the S&P 500 for a spread of LIBOR plus 35 basis points. Please assume that you can invest cash at LIBOR + 25 bps. Please compare the expected returns of the S&P 500 futures strategy with a comparable strategy using S&P 500 swaps. Which strategy would you prefer? f) How much does the calendar spread mispricing in the September 2020 and December 2020 and December 2020 and March 2021 S&P 500 futures contracts have to change for your recommendation in 1(e) to change? Question 2 (30 points) Using Bloomberg, The Wall Street Journal, Yahoo Finance, and CBOE.COM as sources, please answer the following questions: a) Find a call option on your favorite stock and describe its terms, including its current price and intrinsic value. b) How many call options could you buy with $10,000 to invest? To answer this question, please ignore transaction costs. c) Please break the time premium of the call into four components; gross carry, dividends, net carry and insurance. lost d) Where are the puts on the stock with the same strike price and expiration trading? What is the Fair Value of those puts using the put/call parity formula? e) What is the forward price of the stock at expiration? f) Please calculate the annualized historical volatility of your stock over the time period you feel is most appropriate using actual stock price data. g) Using CBOE.com, please calculate the Implied Volatility of the call option using the same interest rate and dividend yield used in earlier parts of the question. Ignore transaction costs. h) Based on the Implied Volatility above, what is the probability that the option will be exercised? Please do not answer the question by providing me the Delta of the option.

Step by Step Solution

There are 3 Steps involved in it

Answer 1 d Assuming no credit risk from SPDR Trust or the Futures Clearing Corporation ETFs generally have a higher expected return than futures for investors unwilling to accept credit risk This is b... View full answer

Get step-by-step solutions from verified subject matter experts