Question: d Write down formulas to enter into excel as well, question is already answered but it is wrong. A) Create an amortization table for a

d

d

Write down formulas to enter into excel as well, question is already answered but it is wrong.

Write down formulas to enter into excel as well, question is already answered but it is wrong.

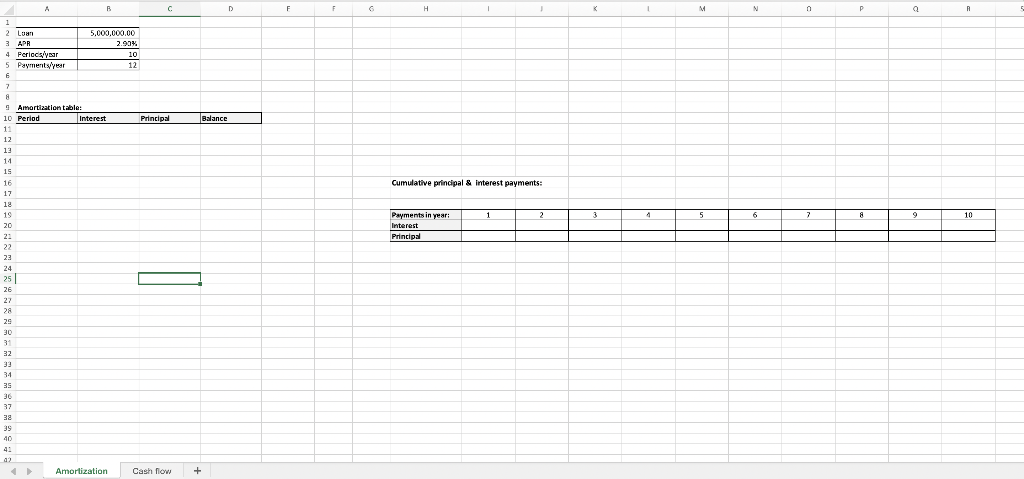

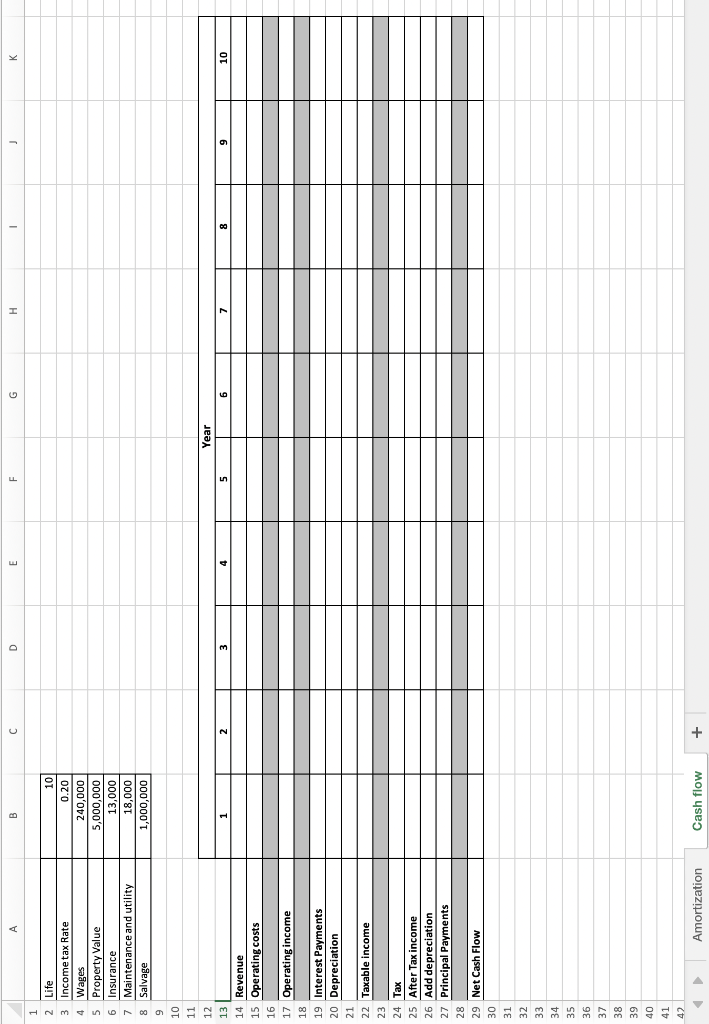

A) Create an amortization table for a business with the following information. Loan: $5,000,000 Annual interest rate: 2.9% Loan period: 10 years Payments: monthly, end of each month Loan will be fully paid in 10 years. Assignment 9 - Data B) Create a table to show cumulative interest payments and cumulative principal payments of this loan for each year. C) Build a cash flow table for a service business using the loan information from parts "A" and "B". Calculate net cash flow for duration of the projects. Additional information is as follows: - Facility lifetime: 10 years - Investment on the facility and equipment: $5,000,000 - Salvage value: $1,000,000 - Annual revenue: $650,000 first year, 10% increase for year 2 , and 20% annual increase after that - Annual operating costs: - Insurance: $13,000 - Maintenance and utility: $18,000 - Wages: $240,000 - Income tax rate: 20\%. This business does not pay any tax when there is a loss. There is no tax credit for the future. im +? A) Create an amortization table for a business with the following information. Loan: $5,000,000 Annual interest rate: 2.9% Loan period: 10 years Payments: monthly, end of each month Loan will be fully paid in 10 years. Assignment 9 - Data B) Create a table to show cumulative interest payments and cumulative principal payments of this loan for each year. C) Build a cash flow table for a service business using the loan information from parts "A" and "B". Calculate net cash flow for duration of the projects. Additional information is as follows: - Facility lifetime: 10 years - Investment on the facility and equipment: $5,000,000 - Salvage value: $1,000,000 - Annual revenue: $650,000 first year, 10% increase for year 2 , and 20% annual increase after that - Annual operating costs: - Insurance: $13,000 - Maintenance and utility: $18,000 - Wages: $240,000 - Income tax rate: 20\%. This business does not pay any tax when there is a loss. There is no tax credit for the future. im +?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts