Question: D.1. Make a sample of elevator pitch to explain to someone that internal controls are not obstacles to business success but rather enablers? D.2. Accounts

D.1. Make a sample of "elevator pitch" to explain to someone that internal controls are not obstacles to business success but rather enablers?

D.2.Accounts Payable System at Bado Clothing Company. The following narrative describes the accounts payable and cash disbursements system at Bado Clothing Company. The narrative has been organized according to the events in the process.

Record supplier invoices. The accounts payable clerk picks up mail from the mailroom. She stamps the invoice with the current date and pulls the corresponding purchase orders from the unpaid file drawer. She also pulls receiving documents to make sure that the items were received. Then she checks to see if prices and quantities match on the documents. She assembles a data entry packet that includes the purchase order, invoice, and receiving document. She stamps the prepared packets with a voucher number and writes the supplier number. The accounts payable clerk adds shipping and handling charges if necessary. When enough invoices are accumulated, she counts the invoices and calculates the total of the batch of invoices. She enters the batch into the computer. The invoices are recorded in an Invoice File. The invoice record includes an Invoice_Status field. This field is set to "open" when the invoice is recorded. The computer prints a batch summary listing showing the number of invoices and total amount of the invoices. The clerk checks the computer total with the manual total.

Make a checks. The accounts payable clerk prepares checks for payment every week. The system generates a list of all open invoices that should be paid this week. An invoice will be selected for payment if an early payment discount would be lost by waiting until next week of if the invoice would become past due by next week. The clerk prints a cash requirements report that lists each invoice selected for payment and the total cash required. She compares the checkbook balance to the report to determine whether there is adequate cash to make the required payments. The payments are recorded in a Payment File, and the status of the invoice is changed to"paid" in the Invoice File. Then, the clerk prints two-part checks.

Stamp Checks. She gives the checks to the controller. The controller puts a signature stamp on the checks.

Make Payment. The accounts payable clerk then staples one part of the check to the invoice and mails the other part to the supplier. She files the paid claims in the Paid File.

Instructions :

1. Identify at least five risks, suggest a possible cause, and indicate the related event.

2. List two continuous monitoring/auditing routines you would recommend for Bado Clothing Company for its Accounts Payable System. Specify what data would be collected, how it would be analyzed, the reporting mechanism, and frequency of its preparation.

W4-3 Tasty Burger. A customer arrives at Tasty Burger and waits in line to place an order. When an employee becomes available, the customer places an order. The employee keys the order information into the register, which is appoint-of-sale device, connected to an office computer. The register displays the amount due. The employee collects the amount due and gives the customer his or her change. The computer records the sale and updates the inventory. The employee then gives the food to the customer.

Registers are assigned to employees for the duration of their shifts. When this shift is over, the manager either reassigns the drawer to someone else or decides to close it. To close the drawer, the manager enters a register report command. The register generates a report showing how much cash should be in the drawer. The manager then counts the actual cash in the drawer, compares it to the register's amount, and records the overage or shortage (if any).

At the end of the day, the manager closes all the drawers, counts the cash and prepares a daily summary report. The report includes total amount collected, sales, sales tax and amount short ot over for the day.

After finishing the report, the manager leaves the restaurant and deposits the cash in the night deposit slot at the bank.

Instructions:

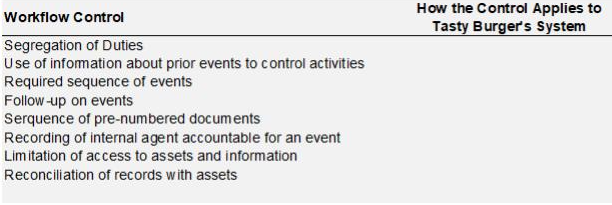

1. Study the narrative for Tasty Burger to identify internal controls. Create an answer using the format given in the following table. For each control, comment in the second column on whether it is used by Tasty Burger or how it could be used. If the control is not appropriate for this system, explain why.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts