Question: D1. Prepare a table showing: ROCE, RNOA, FLEV, NBC/RNFA, SPREAD for FY18, FY19 and FY20. Also show the inputs used in these calculation. Calculate these

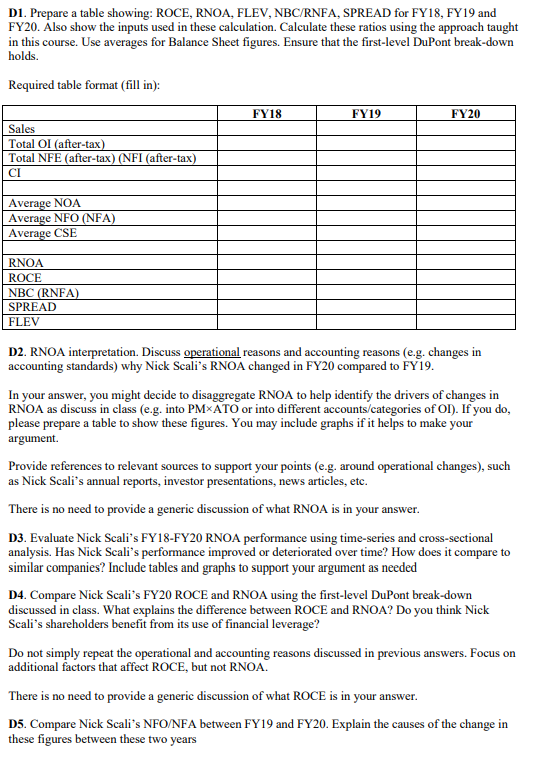

D1. Prepare a table showing: ROCE, RNOA, FLEV, NBC/RNFA, SPREAD for FY18, FY19 and FY20. Also show the inputs used in these calculation. Calculate these ratios using the approach taught in this course. Use averages for Balance Sheet figures. Ensure that the first-level DuPont break-down holds. Required table format (fill in): FY18 FY19 FY20 Sales Total OI (after-tax) Total NFE (after-tax) (NFI (after-tax) CI Average NOA Average NFO (NFA) Average CSE RNOA ROCE NBC (RNFA) SPREAD FLEV D2. RNOA interpretation. Discuss operational reasons and accounting reasons (e.g. changes in accounting standards) why Nick Scali's RNOA changed in FY20 compared to FY19. In your answer, you might decide to disaggregate RNOA to help identify the drivers of changes in RNOA as discuss in class (e.g. into PM ATO or into different accounts/categories of OI). If you do, please prepare a table to show these figures. You may include graphs if it helps to make your argument. Provide references to relevant sources to support your points (e.g. around operational changes), such as Nick Scali's annual reports, investor presentations, news articles, etc. There is no need to provide a generic discussion of what RNOA is in your answer. D3. Evaluate Nick Scali's FY18-FY20 RNOA performance using time-series and cross-sectional analysis. Has Nick Scali's performance improved or deteriorated over time? How does it compare to similar companies? Include tables and graphs to support your argument as needed D4. Compare Nick Scali's FY20 ROCE and RNOA using the first-level DuPont break-down discussed in class. What explains the difference between ROCE and RNOA? Do you think Nick Scali's shareholders benefit from its use of financial leverage? Do not simply repeat the operational and accounting reasons discussed in previous answers. Focus on additional factors that affect ROCE, but not RNOA There is no need to provide a generic discussion of what ROCE is in your answer. D5. Compare Nick Scali's NFO/NFA between FY19 and FY20. Explain the causes of the change in these figures between these two years D1. Prepare a table showing: ROCE, RNOA, FLEV, NBC/RNFA, SPREAD for FY18, FY19 and FY20. Also show the inputs used in these calculation. Calculate these ratios using the approach taught in this course. Use averages for Balance Sheet figures. Ensure that the first-level DuPont break-down holds. Required table format (fill in): FY18 FY19 FY20 Sales Total OI (after-tax) Total NFE (after-tax) (NFI (after-tax) CI Average NOA Average NFO (NFA) Average CSE RNOA ROCE NBC (RNFA) SPREAD FLEV D2. RNOA interpretation. Discuss operational reasons and accounting reasons (e.g. changes in accounting standards) why Nick Scali's RNOA changed in FY20 compared to FY19. In your answer, you might decide to disaggregate RNOA to help identify the drivers of changes in RNOA as discuss in class (e.g. into PM ATO or into different accounts/categories of OI). If you do, please prepare a table to show these figures. You may include graphs if it helps to make your argument. Provide references to relevant sources to support your points (e.g. around operational changes), such as Nick Scali's annual reports, investor presentations, news articles, etc. There is no need to provide a generic discussion of what RNOA is in your answer. D3. Evaluate Nick Scali's FY18-FY20 RNOA performance using time-series and cross-sectional analysis. Has Nick Scali's performance improved or deteriorated over time? How does it compare to similar companies? Include tables and graphs to support your argument as needed D4. Compare Nick Scali's FY20 ROCE and RNOA using the first-level DuPont break-down discussed in class. What explains the difference between ROCE and RNOA? Do you think Nick Scali's shareholders benefit from its use of financial leverage? Do not simply repeat the operational and accounting reasons discussed in previous answers. Focus on additional factors that affect ROCE, but not RNOA There is no need to provide a generic discussion of what ROCE is in your answer. D5. Compare Nick Scali's NFO/NFA between FY19 and FY20. Explain the causes of the change in these figures between these two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts