Question: D7 X Y fx A B C D E F G H K L M N O P Q R S T U V 2

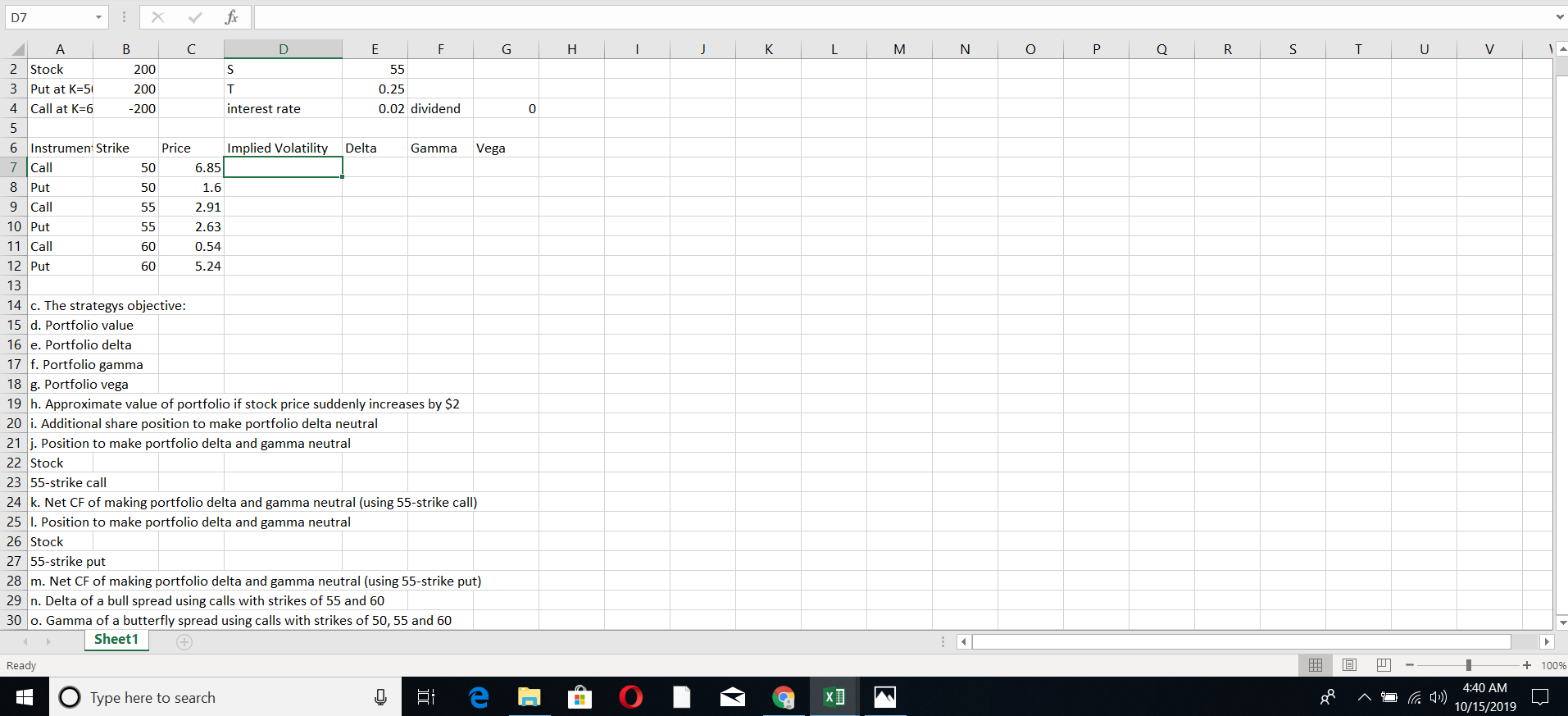

D7 X Y fx A B C D E F G H K L M N O P Q R S T U V 2 Stock 200 S 55 3 Put at K=5 200 0.25 4 Call at K=6 UT -200 interest rate 0.02 dividend 0 6 Instrumen Strike Price Implied Volatility Delta Gamma Vega 7 | Call 50 6.85 8 Put 50 1.6 9 Call 55 2.91 10 Put 55 2.63 11 Call 60 0.54 12 Put 60 5.24 13 14 c. The strategys objective: 15 d. Portfolio value 16 e. Portfolio delta 17 f. Portfolio gamma 18 g. Portfolio vega 19 h. Approximate value of portfolio if stock price suddenly increases by $2 20 i. Additional share position to make portfolio delta neutral 21 j. Position to make portfolio delta and gamma neutral 22 Stock 23 55-strike call 24 k. Net CF of making portfolio delta and gamma neutral (using 55-strike call) 25 1. Position to make portfolio delta and gamma neutral 26 Stock 27 55-strike put 28 m. Net CF of making portfolio delta and gamma neutral (using 55-strike put) 29 n. Delta of a bull spread using calls with strikes of 55 and 60 30 o. Gamma of a butterfly spread using calls with strikes of 50, 55 and 60 Sheet1 + Ready + 100% O Type here to search x ] 4:40 AM 10/15/2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts