Question: Daily Driver, Incorporated (DDI), operates a driving service through a popular ride-sharing app. DDI has prepared a list of unadjusted account balances at its December

Daily Driver, Incorporated (DDI), operates a driving service through a popular ride-sharing app. DDI has prepared a list of unadjusted account balances at its December 31 year-end. You have reviewed the balances and made notes shown in the right column.

| DAILY DRIVER, INCORPORATED | |||

| Unadjusted Trial Balance | |||

| At December 31 | |||

| Account Name | Debit | Credit | Notes |

|---|---|---|---|

| Cash | $ 1,950 | This equals the bank balance. | |

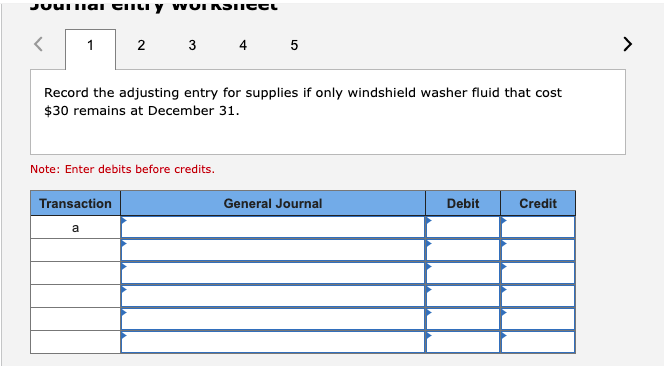

| Supplies | 240 | Only windshield washer fluid that cost $30 remains at December 31. | |

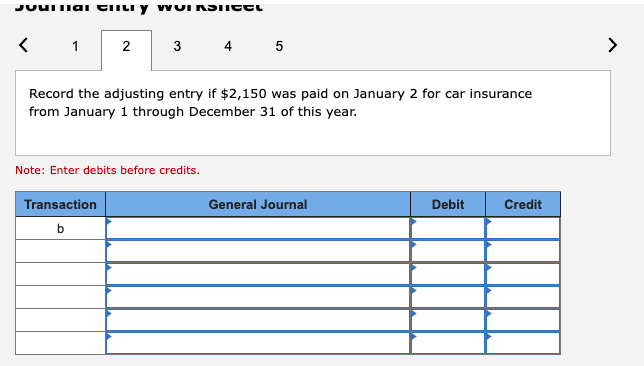

| Prepaid Insurance | 2,150 | This amount was paid January 2 for car insurance from January 1 through December 31 of this year. | |

| Equipment | 78,000 | This is the cars purchase price. | |

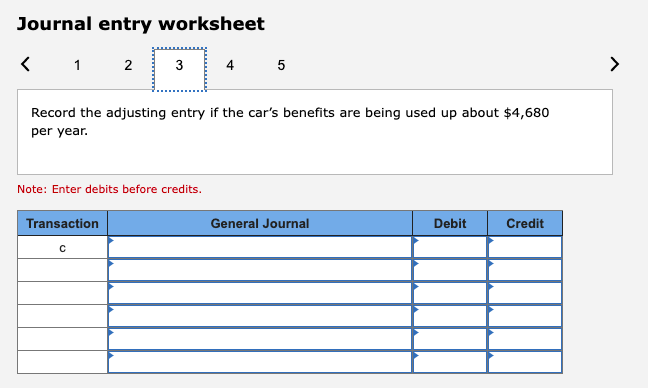

| Accumulated Depreciation | $ 4,680 | The car will be two years old at the end of December. | |

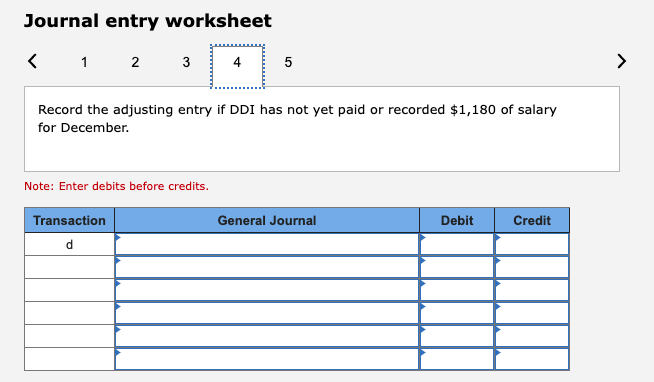

| Salaries and Wages Payable | 0 | DDI has not yet paid or recorded $1,180 of salary for December. | |

| Income Tax Payable | 0 | DDI paid all its taxes from last year. | |

| Common Stock | 44,000 | DDI issued 8,800 shares at $5 each. | |

| Retained Earnings | 6,380 | This is the total accumulated earnings to January 1 of this year. | |

| Service Revenue | 42,370 | All revenue is received in cash when the service is given. | |

| Salaries and Wages Expense | 12,600 | DDIs only employee receives a salary of $1,180 for December. | |

| Supplies Expense | 290 | This is the cost of windshield washer fluid used to November 30. | |

| Depreciation Expense | 0 | The cars benefits are being used up about $4,680 per year. | |

| Insurance Expense | 0 | No car insurance has been paid for next year. | |

| Fuel Expense | 2,200 | All fuel is paid for in cash. | |

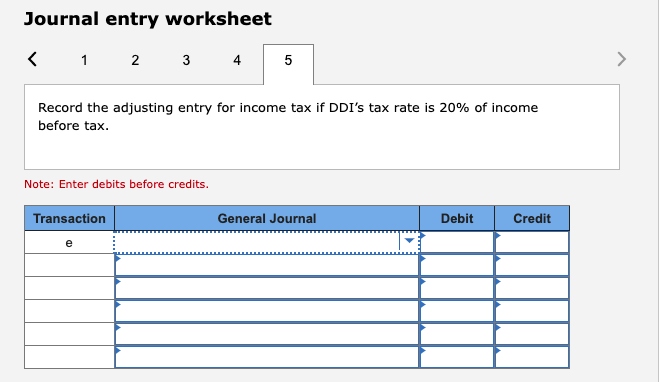

| Income Tax Expense | 0 | DDIs tax rate is 20% of income before tax. | |

| Totals | $ 97,430 | $ 97,430 | |

Required:

Prepare the adjusting journal entries for the year ended December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

OPTIONS FOR GENERAL JOURNAL SECTION:

- No Journal Entry Required

- Accounts Payable

- Accounts Receivable

- Accumulated Amortization

- Accumulated Depreciation

- Advertising Expense

- Amortization Expense

- Bad Debt Expense

- Bank Charges Expense

- Buildings

- Cash

- Common Stock

- Copyrights

- Cost of Goods Sold

- Deferred Revenue

- Delivery Expense

- Depreciation Expense

- Dividends

- Dividends Payable

- Donation Revenue

- Equipment

- Franchise Rights

- Goodwill

- Income Tax Expense

- Income Tax Payable

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Legal Expense

- Licensing Rights

- Logo and Trademarks

- Notes Payable (long-term)

- Notes Payable (short-term)

- Notes Receivable (long-term)

- Notes Receivable (short-term)

- Office Expense

- Patents

- Prepaid Advertising

- Prepaid Insurance

- Prepaid Rent

- Rent Expense

- Rent Revenue

- Repairs and Maintenance Expense

- Retained Earnings

- Salaries and Wages Expense

- Salaries and Wages Payable

- Sales Revenue

- Selling, General, and Administrative Expense

- Service Revenue

- Short-term Investments

- Software

- Supplies

- Supplies Expense

- Travel Expense

- Utilities Expense

- Vehicles

JUuilMai Vily VINPIIce 1 2 3 4 5 > Record the adjusting entry for supplies if only windshield washer fluid that cost $30 remains at December 31. Note: Enter debits before credits. General Journal Debit Credit Transaction a JUuIIII TIIUI VINPICS Record the adjusting entry if $2,150 was paid on January 2 for car insurance from January 1 through December 31 of this year. Note: Enter debits before credits. General Journal Debit Credit Transaction b Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts