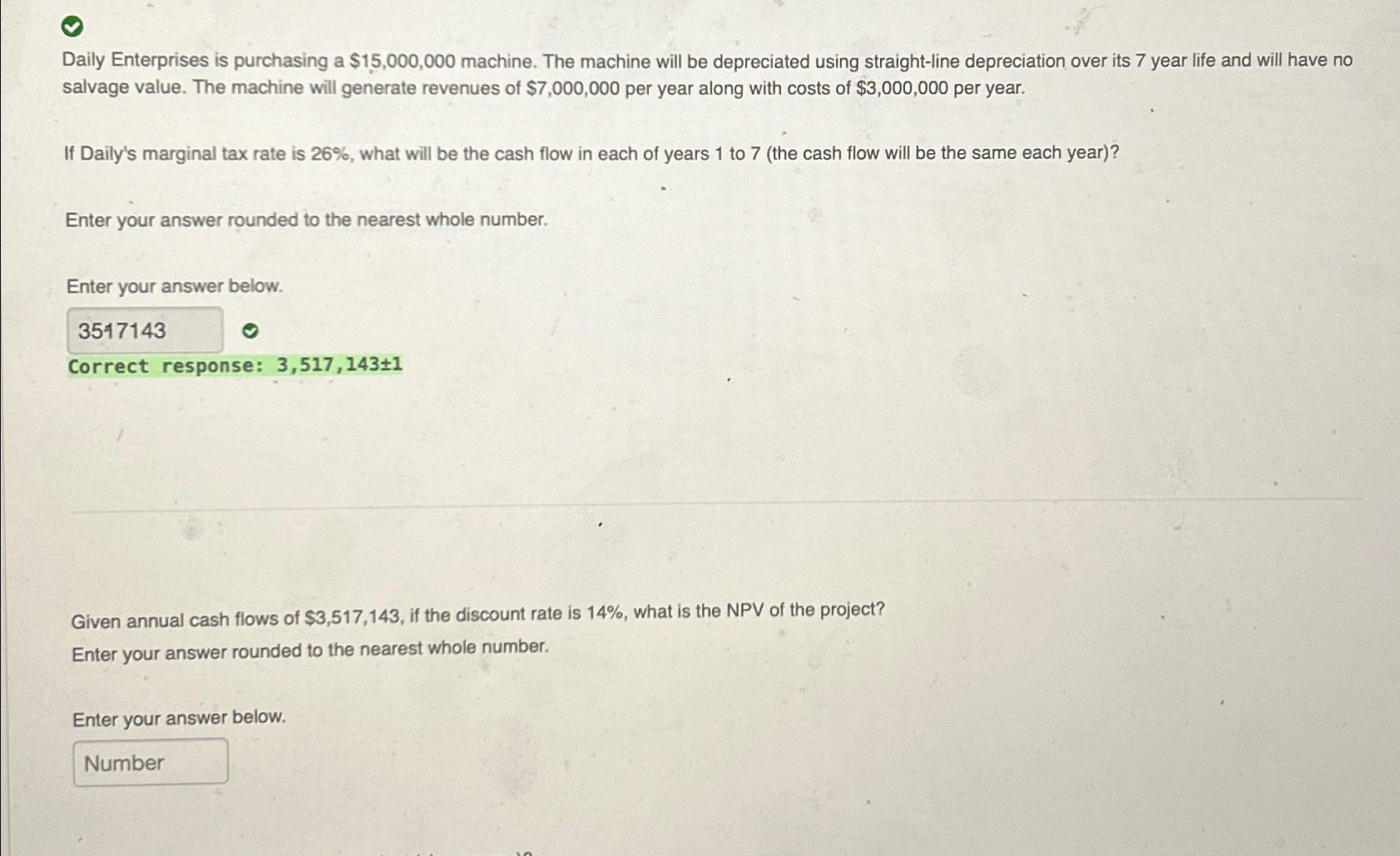

Question: Daily Enterprises is purchasing a $ 1 5 , 0 0 0 , 0 0 0 machine. The machine will be depreciated using straight -

Daily Enterprises is purchasing a $ machine. The machine will be depreciated using straightline depreciation over its year life and will have no salvage value. The machine will generate revenues of $ per year along with costs of $ per year.

If Daily's marginal tax rate is what will be the cash flow in each of years to the cash flow will be the same each year

Enter your answer rounded to the nearest whole number.

Enter your answer below.

Correct response:

Given annual cash flows of $ if the discount rate is what is the NPV of the project?

Enter your answer rounded to the nearest whole number.

Enter your answer below

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock