Question: Daily Enterprises is purchasing a $9.9 million machine. It will cost $51,000 to transport and install the machine. The machine has a depreciable life of

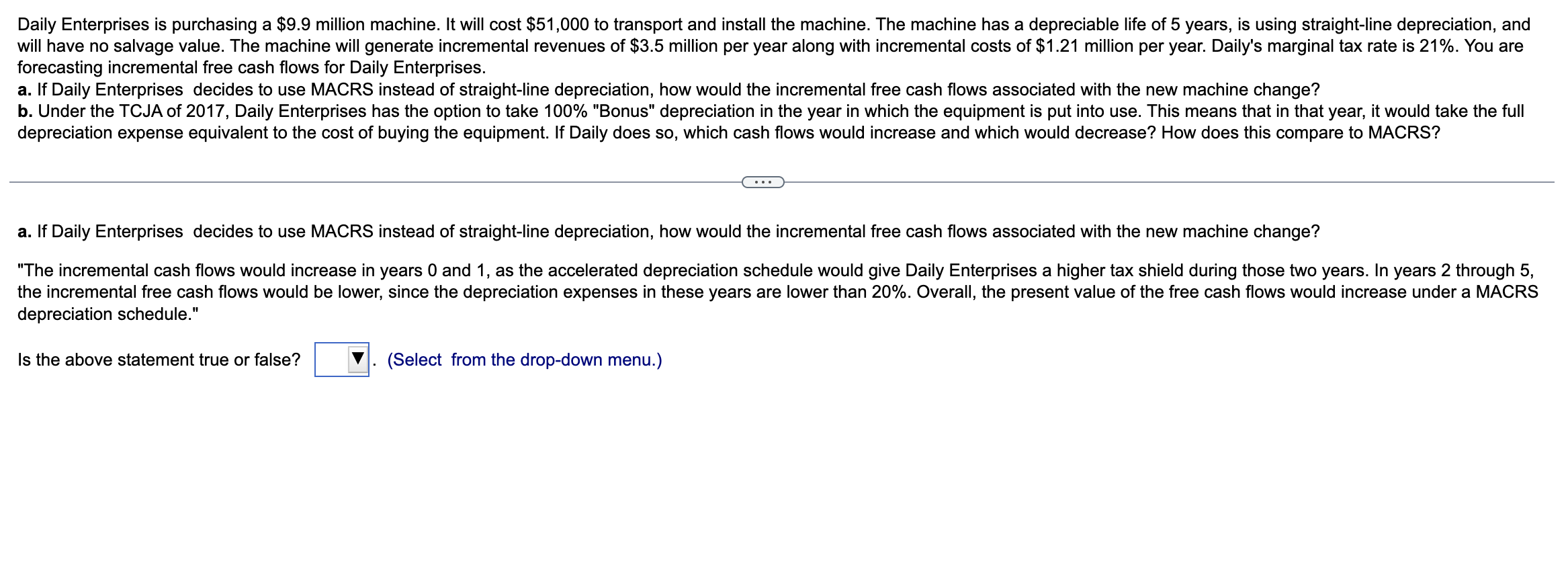

Daily Enterprises is purchasing a $9.9 million machine. It will cost $51,000 to transport and install the machine. The machine has a depreciable life of 5 years, is using straight-line depreciation, and will have no salvage value. The machine will generate incremental revenues of $3.5 million per year along with incremental costs of $1.21 million per year. Daily's marginal tax rate is 21%. You are forecasting incremental free cash flows for Daily Enterprises. a. If Daily Enterprises decides to use MACRS instead of straight-line depreciation, how would the incremental free cash flows associated with the new machine change? b. Under the TCJA of 2017, Daily Enterprises has the option to take 100% "Bonus" depreciation in the year in which the equipment is put into use. This means that in that year, it would take the full depreciation expense equivalent to the cost of buying the equipment. If Daily does so, which cash flows would increase and which would decrease? How does this compare to MACRS? a. If Daily Enterprises decides to use MACRS instead of straight-line depreciation, how would the incremental free cash flows associated with the new machine change? "The incremental cash flows would increase in years 0 and 1, as the accelerated depreciation schedule would give Daily Enterprises a higher tax shield during those two years. In years 2 through 5 , the incremental free cash flows would be lower, since the depreciation expenses in these years are lower than 20%. Overall, the present value of the free cash flows would increase under a MACRS depreciation schedule." Is the above statement true or false? (Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts