Question: Dakota Martin sold a piece of land in 2020 for $350,000. The land was recognized as capital property. The original cost of the land

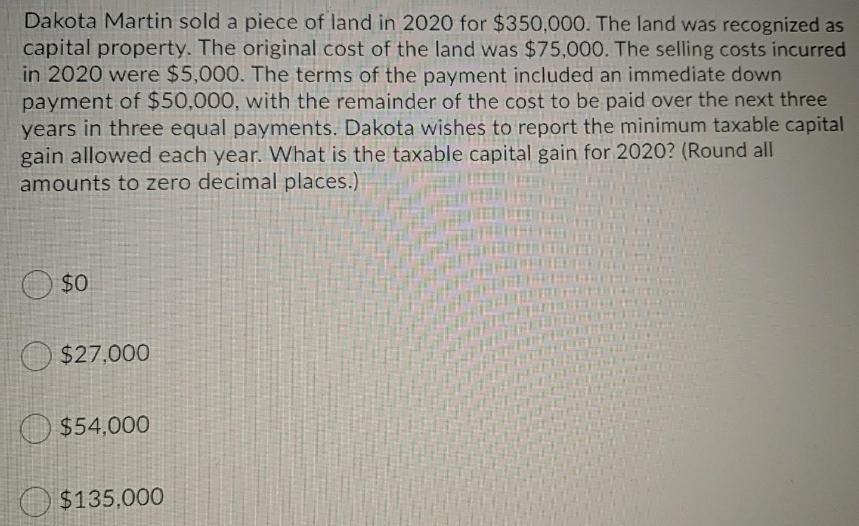

Dakota Martin sold a piece of land in 2020 for $350,000. The land was recognized as capital property. The original cost of the land was $75,000. The selling costs incurred in 2020 were $5,000. The terms of the payment included an immediate down payment of $50,000, with the remainder of the cost to be paid over the next three years in three equal payments. Dakota wishes to report the minimum taxable capital gain allowed each year. What is the taxable capital gain for 2020? (Round all amounts to zero decimal places.) $0 O $27,000 O $54,000 O $135,000

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

27000 is the correct answer the answer is very correct Gain Proceeds o... View full answer

Get step-by-step solutions from verified subject matter experts