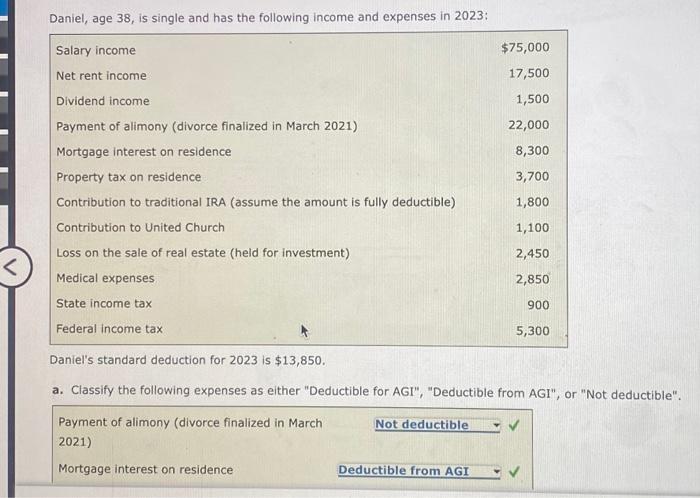

Question: Daniel, age 38 , is single and has the following income and expenses in 2023 : Daniel's standard deduction for 2023 is $13,850. a. Classify

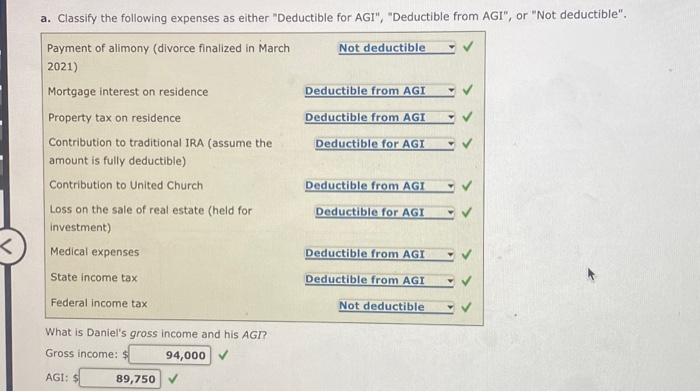

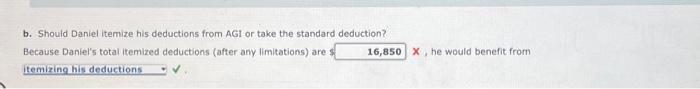

Daniel, age 38 , is single and has the following income and expenses in 2023 : Daniel's standard deduction for 2023 is $13,850. a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". What is Daniel's gross income and his AGI? Gross income: AGI: b. Should Daniel itemize his deductions from AGI or take the standard deduction? Because Daniel's total itemized deductions (after any limitations) are 1 x, he would benefit from

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock