Question: Daniel, an electrical engineer, resigned from Tenaga Nasional Berhad to start his own trading in electrical goods. He required the following assets: Furniture and

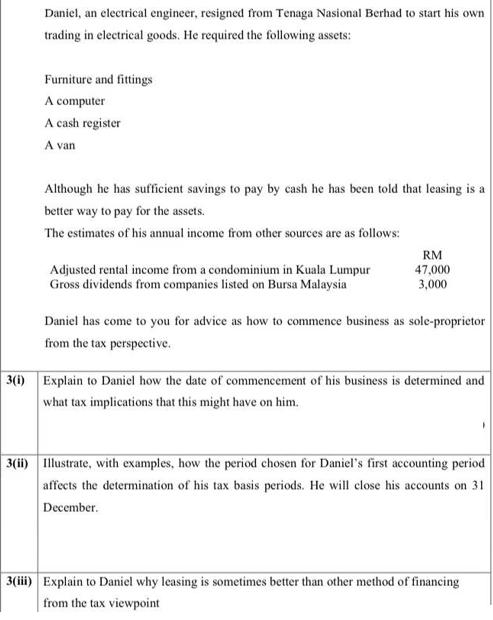

Daniel, an electrical engineer, resigned from Tenaga Nasional Berhad to start his own trading in electrical goods. He required the following assets: Furniture and fittings A computer A cash register A van Although he has sufficient savings to pay by cash he has been told that leasing is a better way to pay for the assets. The estimates of his annual income from other sources are as follows: RM Adjusted rental income from a condominium in Kuala Lumpur Gross dividends from companies listed on Bursa Malaysia 47,000 3,000 Daniel has come to you for advice as how to commence business as sole-proprietor from the tax perspective. 3(1) Explain to Daniel how the date of commencement of his business is determined and what tax implications that this might have on him. 3(ii) Illustrate, with examples, how the period chosen for Daniel's first accounting period affects the determination of his tax basis periods. He will close his accounts on 31 December. 3(iii) Explain to Daniel why leasing is sometimes better than other method of financing from the tax viewpoint

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Here given the details of commencement of business which can be influence in taxation affairs and benefits of taxation which are related to this as well Here below given the required details related t... View full answer

Get step-by-step solutions from verified subject matter experts