Question: Daniel Cahill successfully got his credit application approved last month by the Commonwealth Bank of Australia for a loan of $60,000. The bank requires

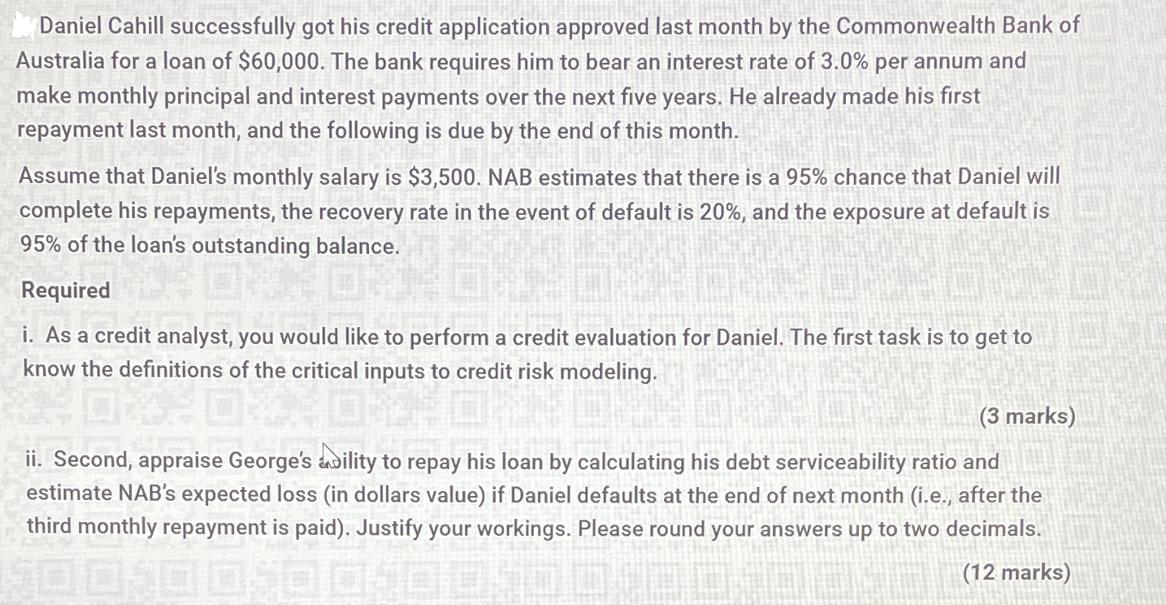

Daniel Cahill successfully got his credit application approved last month by the Commonwealth Bank of Australia for a loan of $60,000. The bank requires him to bear an interest rate of 3.0% per annum and make monthly principal and interest payments over the next five years. He already made his first repayment last month, and the following is due by the end of this month. Assume that Daniel's monthly salary is $3,500. NAB estimates that there is a 95% chance that Daniel will complete his repayments, the recovery rate in the event of default is 20%, and the exposure at default is 95% of the loan's outstanding balance. Required i. As a credit analyst, you would like to perform a credit evaluation for Daniel. The first task is to get to know the definitions of the critical inputs to credit risk modeling. (3 marks) ii. Second, appraise George's ability to repay his loan by calculating his debt serviceability ratio and estimate NAB's expected loss (in dollars value) if Daniel defaults at the end of next month (i.e., after the third monthly repayment is paid). Justify your workings. Please round your answers up to two decimals. (12 marks) 50 050 050

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided b... View full answer

Get step-by-step solutions from verified subject matter experts