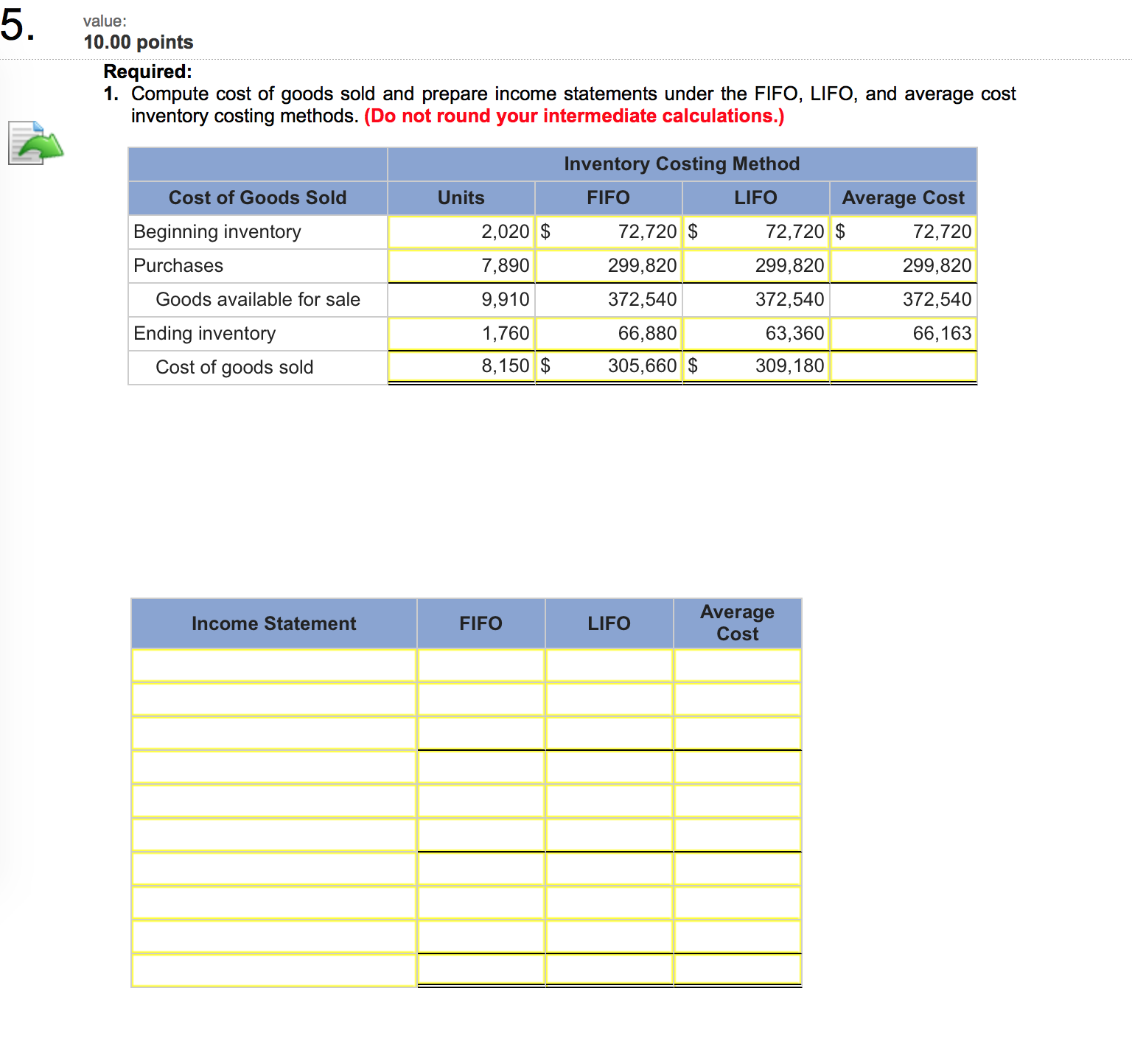

Question: Daniel Company uses a periodic inventory system. Data for 2015: beginning merchandise inventory (December 31, 2014), 2,020 units at $36; purchases, 7,890 units at $38;

Daniel Company uses a periodic inventory system. Data for 2015: beginning merchandise inventory (December 31, 2014), 2,020 units at $36; purchases, 7,890 units at $38; expenses (excluding income taxes), $192,900; ending inventory per physical count at December 31, 2015, 1,760; sales, 8,150 units; sales price per unit, $76; and average income tax rate, 36 percent.

Questions

1) Average Cost in last cell

2) Income Statement? With the necessary equations, for explanation?

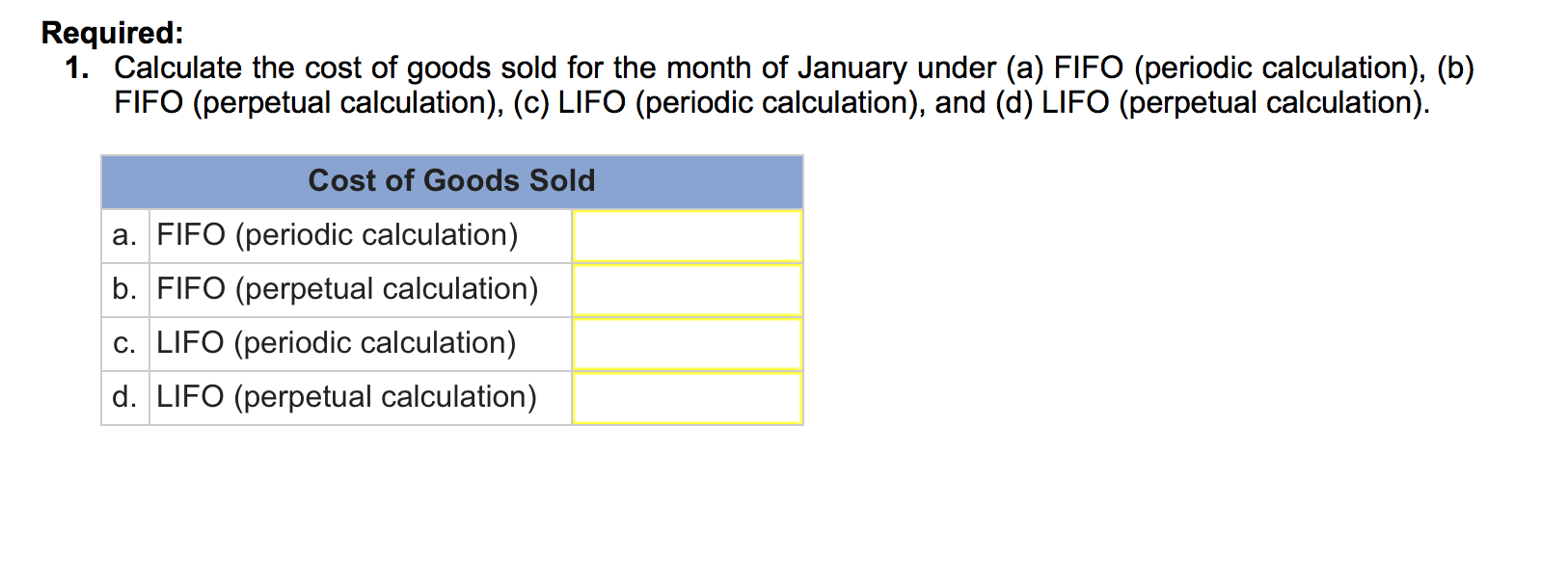

| Assume that a retailer?s beginning inventory and purchases of a popular item during January included: (1) 320 units at $7.2 in beginning inventory on January 1, (2) 470 units at $8.2 purchased on January 8, and (3) 770 units at $9.2 purchased on January 29. The company sold 370 units on January 12 and 570 units on January 30.

Questions 1) Value of each calculation, with the necessary equations, for explanation?

|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts