Question: Daniel Company uses a periodic inventory system. Data for the current year. beginning merchandise inventory ( ending inventory December 3 1 , prior year )

Daniel Company uses a periodic inventory system. Data for the current year. beginning merchandise inventory ending inventory December prior year units at $; purchases, units at $; expenses excluding income taxes $; ending inventory per physical count at December current year, units; sales, units; sales price per unit, $; and average income tax rate, percent.

Required:

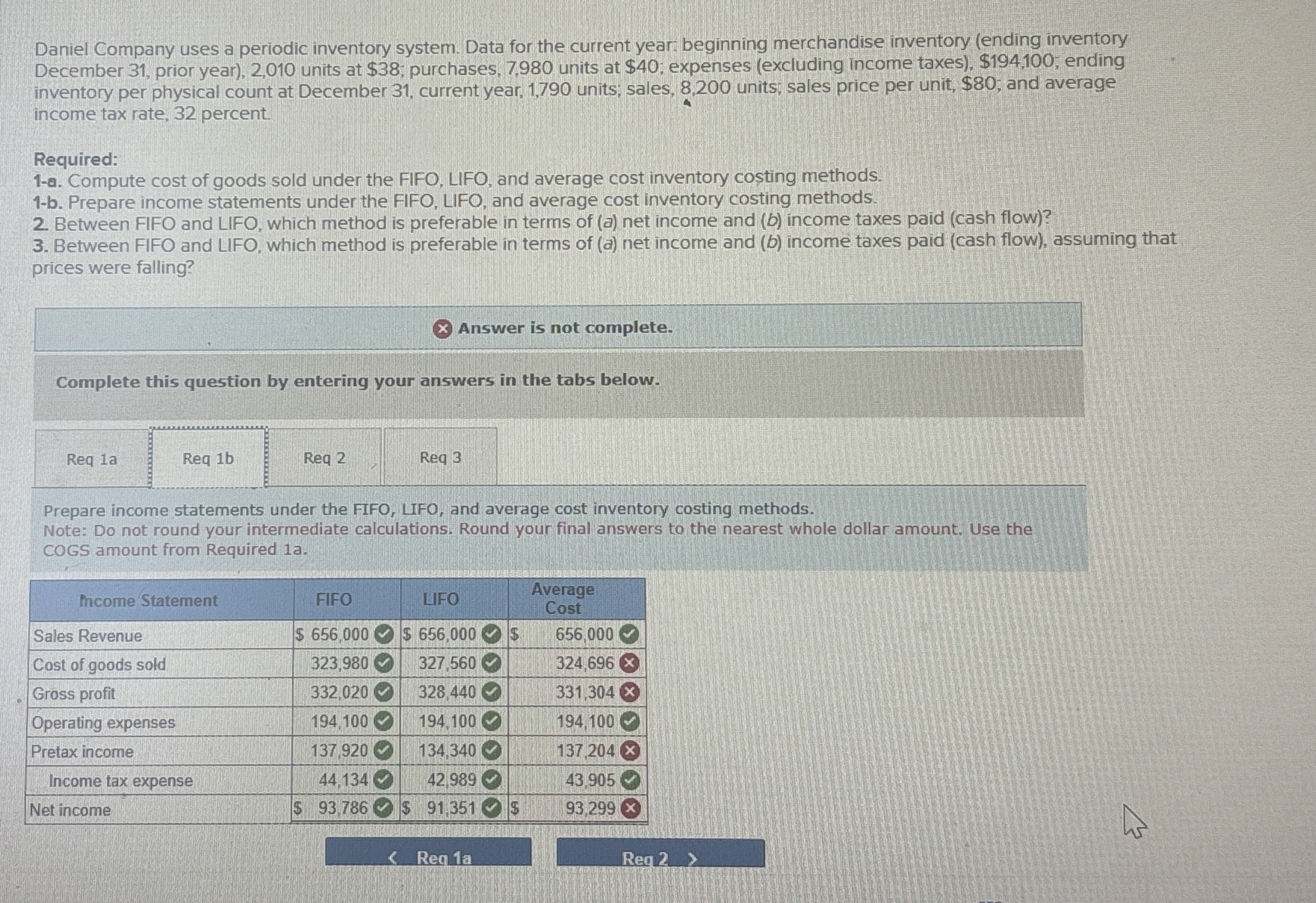

a Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods.

b Prepare income statements under the FIFO, LIFO, and average cost inventory costing methods.

Between FIFO and LIFO, which method is preferable in terms of a net income and b income taxes paid cash flow

Between FIFO and LIFO, which method is preferable in terms of a net income and b income taxes paid cash flow assuming that prices were falling?

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Req a Req b Req Req R

Prepare income statements under the FIFO, LFO, and average cost inventory costing methods.

Note: Do not round your intermediate calculations. Round your final answers to the nearest whole dollar amount. Use the COGS amount from Required a

tablefhcome Statement,FIFO,LFO,tableAverageCostSales Revenue,$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock