Question: Danube, Toggle, and ConnectOn rely on various intangible assets to operate their businesses. These companies amortize the cost of these assets using the straight-line method

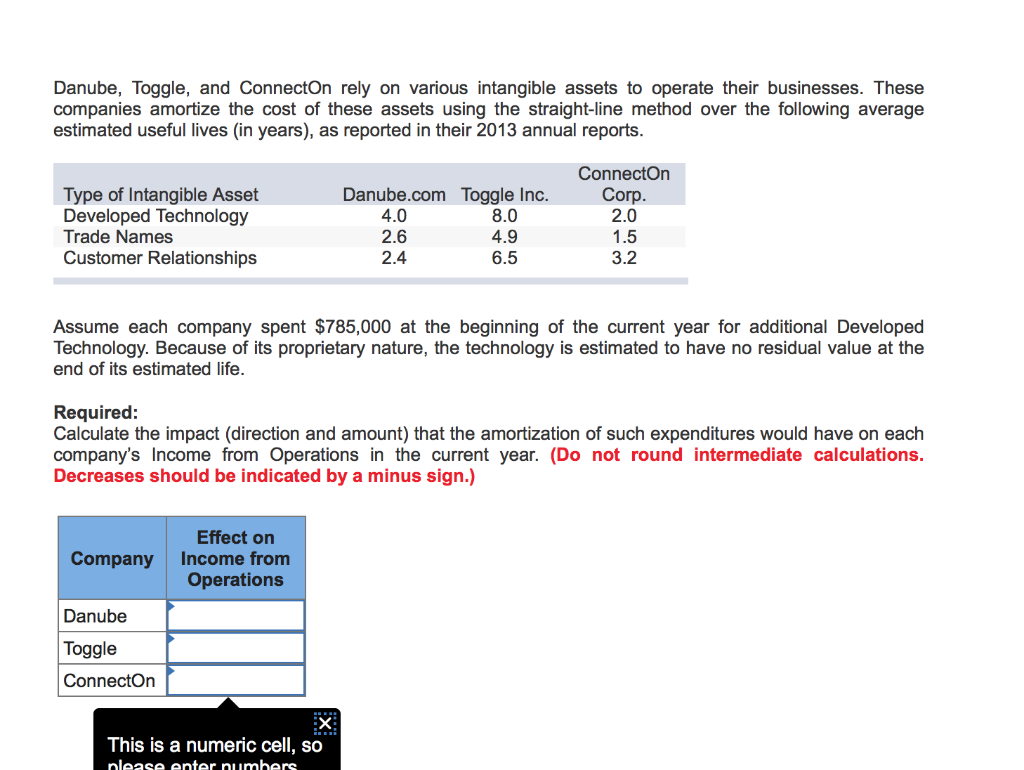

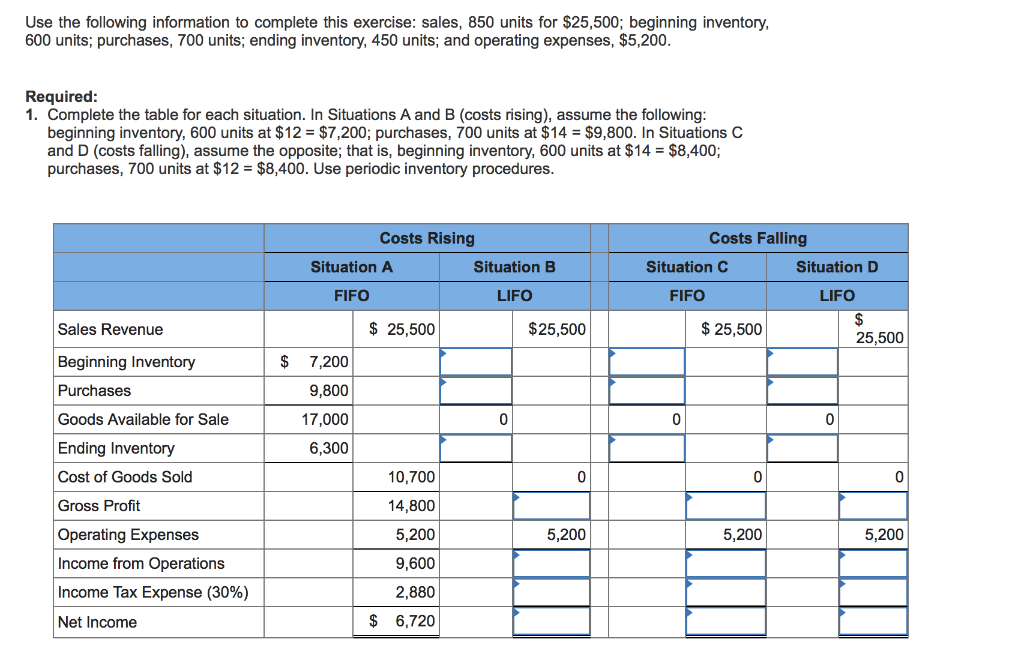

Danube, Toggle, and ConnectOn rely on various intangible assets to operate their businesses. These companies amortize the cost of these assets using the straight-line method over the following average estimated useful lives in years), as reported in their 2013 annual reports. ConnectOn Corp. Type of Intangible Asset Developed Technology Trade Names Customer Relationships Danube.com 4.0 2.6 2.0 Toggle Inc. 8.0 4.9 6.5 2.4 1.5 3.2 Assume each company spent $785,000 at the beginning of the current year for additional Developed Technology. Because of its proprietary nature, the technology is estimated to have no residual value at the end of its estimated life. Required: Calculate the impact (direction and amount) that the amortization of such expenditures would have on each company's Income from Operations in the current year. (Do not round intermediate calculations. Decreases should be indicated by a minus sign.) Company Effect on Income from Operations Danube Toggle ConnectOn This is a numeric cell, so please enter numbers Use the following information to complete this exercise: sales, 850 units for $25,500; beginning inventory, 600 units; purchases, 700 units; ending inventory, 450 units; and operating expenses, $5,200. Required: 1. Complete the table for each situation. In Situations A and B (costs rising), assume the following: beginning inventory, 600 units at $12 = $7,200; purchases, 700 units at $14 = $9,800. In Situations C and D (costs falling), assume the opposite; that is, beginning inventory, 600 units at $14 = $8,400; purchases, 700 units at $12 = $8,400. Use periodic inventory procedures. Costs Falling Situation C Situation D FIFO LIFO $ 25,500 25,500 $ 0 0 Sales Revenue Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Costs Rising Situation A Situation B FIFO LIFO $ 25,500 $25,500 7,200 9,800 17,000 0 6,300 10,700 0 14,800 5,200 5,200 9,600 2,880 $ 6,720 0 5,200 5,200 Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts