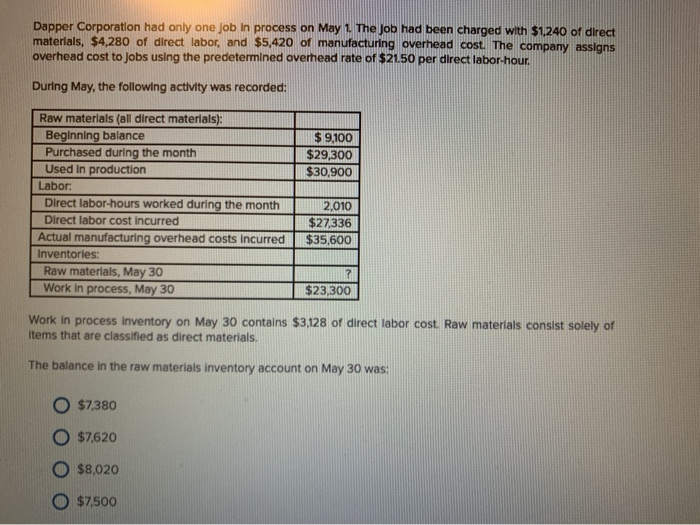

Question: Dapper Corporation had only one Job in process on May 1. The Job had been charged with $1,240 of direct materials, $4,280 of direct labor,

Dapper Corporation had only one Job in process on May 1. The Job had been charged with $1,240 of direct materials, $4,280 of direct labor, and $5,420 of manufacturing overhead cost. The company assigns overhead cost to Jobs using the predetermined overhead rate of $21.50 per direct labor hour. During May, the following activity was recorded: $9,100 $29,300 $30,900 Raw materials (all direct materials): Beginning balance Purchased during the month Used in production Labor: Direct labor-hours worked during the month Direct labor cost incurred Actual manufacturing overhead costs incurred Inventories: Raw materials, May 30 Work in process, May 30 2,010 $27,336 $35,600 ? $23,300 Work in process inventory on May 30 contains $3,128 of direct labor cost. Raw materials consist solely of Items that are classified as direct materials. The balance in the raw materials inventory account on May 30 was $7,380 $7,620 $8,020 $7,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts