Question: Darden Restaurants issues a ( $ 0.35 ) annual dividend to be distributed at the end of every year. They currently have a cost of

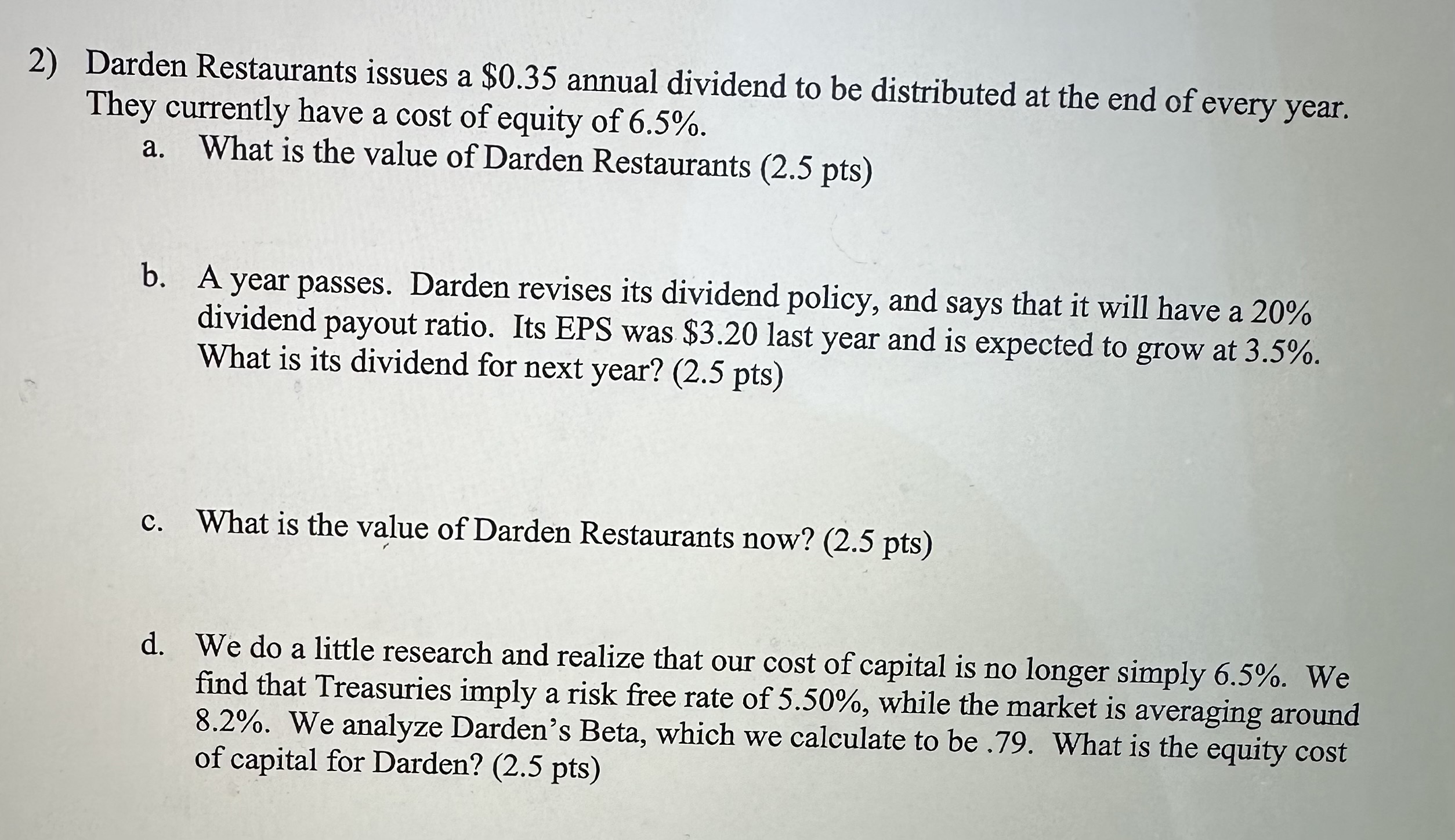

Darden Restaurants issues a \\( \\$ 0.35 \\) annual dividend to be distributed at the end of every year. They currently have a cost of equity of \6.5. a. What is the value of Darden Restaurants ( \\( 2.5 \\mathrm{pts}) \\) b. A year passes. Darden revises its dividend policy, and says that it will have a \20 dividend payout ratio. Its EPS was \\( \\$ 3.20 \\) last year and is expected to grow at \3.5. What is its dividend for next year? (2.5 pts) c. What is the value of Darden Restaurants now? ( \\( 2.5 \\mathrm{pts}) \\) d. We do a little research and realize that our cost of capital is no longer simply \6.5. We find that Treasuries imply a risk free rate of \5.50, while the market is averaging around \8.2. We analyze Darden's Beta, which we calculate to be .79 . What is the equity cost of capital for Darden? (2.5 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts