Question: Data: Alt Lab 9 - 9 data.x | sx Perform the Analysis: Refer to Lab 9 - 9 Alternate in the text for instructions and

Data: Alt Lab data.xsx

Perform the Analysis: Refer to Lab Alternate in the text for instructions and Lab steps for each the of lab parts.

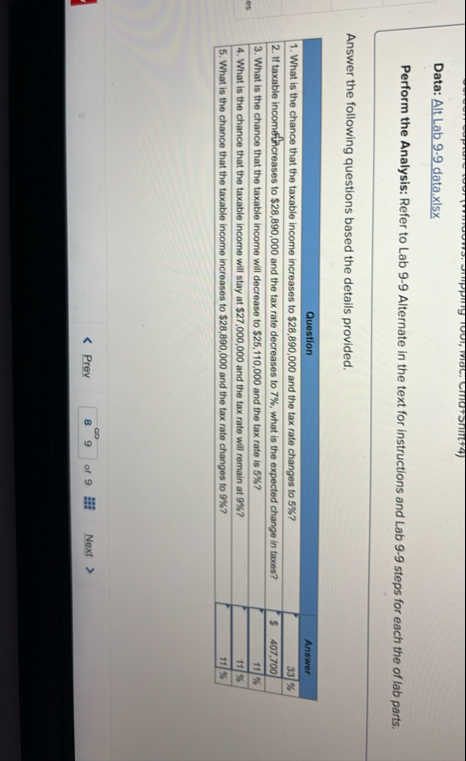

Answer the following questions based the details provided.

tableQuestionAnswer What is the chance that the taxable income increases to $ and the tax rate changes to If taxable incomefthcreases to $ and the tax rate decreases to what is the expected change in taxes?,$ What is the chance that the taxable income will decrease to $ and the tax rate is What is the chance that the taxable income will stay at $ and the tax rate will remain at What is the chance that the taxable income increases to $ and the tax rate changes to

Prey

of

Next

Perform the Analysis: Refer to Lab Alternate in the text for instructions and Lab steps for each the of lab parts.

wer the following questions based the details provided.

Question

Answer

What is the chance that the taxable income increases to $ and the tax rate changes to

f taxable income increases to $ and the tax rate decreases to what is the expected change in taxes?

What is the chance that the taxable income will decrease to $ and the tax rate is

What is the chance that the taxable income will stay at $ and the tax rate will remain at

What is the chance that the taxable income increases to $ and the tax rate changes to

Prev

of

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock