Question: Data Analytics, Inc., an up & coming company based in Seattle, borrowed $50,000 cash on April 1, 2019, signing a one-year 12%, interest-bearing note payable

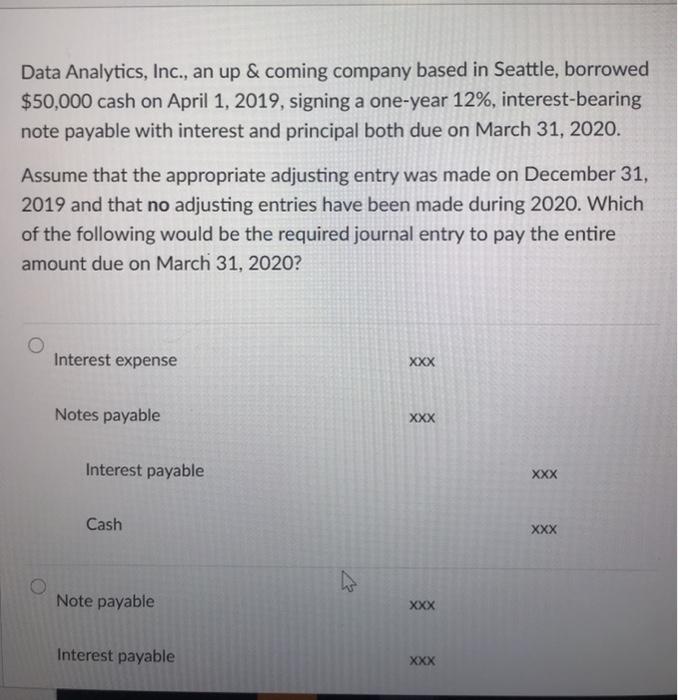

Data Analytics, Inc., an up & coming company based in Seattle, borrowed $50,000 cash on April 1, 2019, signing a one-year 12%, interest-bearing note payable with interest and principal both due on March 31, 2020. Assume that the appropriate adjusting entry was made on December 31, 2019 and that no adjusting entries have been made during 2020. Which of the following would be the required journal entry to pay the entire amount due on March 31, 2020? o Interest expense XXX Notes payable XXX Interest payable XXX Cash XXX Note payable XXX Interest payable XXX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts