Question: data and analysis. Having been trained in business analytics, Lim hoped to derive some useful insights from the data before the meeting. Amazon Founded in

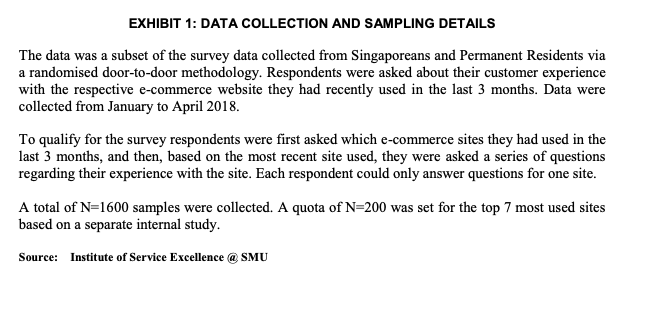

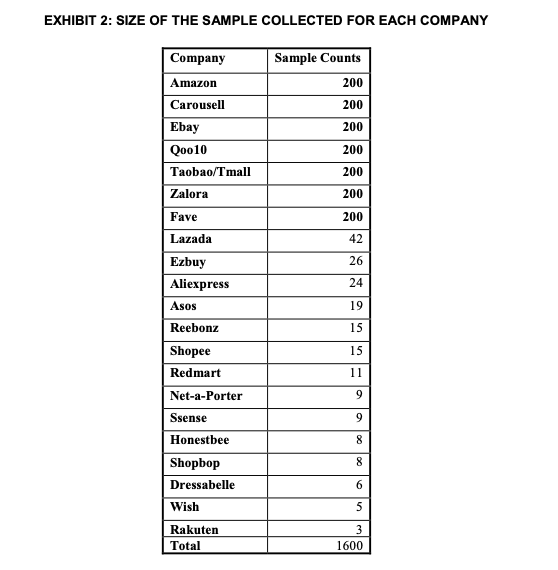

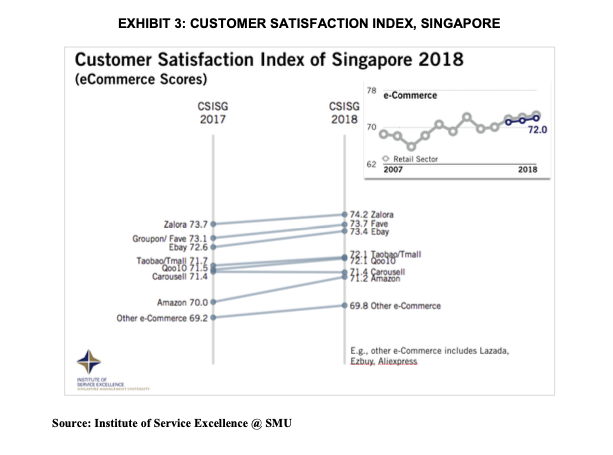

data and analysis. Having been trained in business analytics, Lim hoped to derive some useful insights from the data before the meeting. Amazon Founded in 1994, Amazon was a giant e-commerce platform based in the US. As a marketplace, the company offered a broad range of products and services including Amazon Prime, Amazon Web Services, Prime Video, Amazon Music, Kindle E-readers, Fire tablets, Fire TV, Amazon Echo, and Alexa. \\( { }^{5} \\) In 2005, Amazon launched Amazon Prime, a subscription-based service which provided members with a host of benefits, including unlimited free delivery within two days, same-day, or even two hours for some areas. Apart from delivery, additional perks also included deals, access to movies, TV shows, ad-free songs, games, and e-books. \\( { }^{6} \\) In the year of its launch, Amazon scored 87-points on the ACSI, up from 84-points in the previous year. \\( { }^{7} \\) By 2018, the service had 100 million paid members globally, including in countries like Luxemburg, Mexico, Netherlands and Singapore. \\( { }^{8} \\) In 2019 , membership fees in the US was US \\( \\$ 12.99 \\) per month, or US \\( \\$ 119 \\) annually. Amazon in Singapore In July 2017, a year before the release of the CSISG report, Amazon had introduced Prime Now in Singapore, offering delivery within two-hours of purchase. This was followed by the launch of Amazon Prime later that year in December. \\( { }^{9} \\) Similar to the benefits offered in the US, membership included benefits such as free delivery, deals, and access to video streaming services and games, for the price of US \\( \\$ 2.21 \\) per month. However, despite much fanfare at its launch, many customers were disappointed as they faced a number of issues. These included delivery fulfilment issues for Prime Now during its debut, limited product offerings, and limited content on the video streaming service. Prime Now customers also faced compatibility issues as they did not get a seamless service across Amazon's digital channels and had to use the app instead of the website to place an order. \\( { }^{10} \\) Moreover, existing customers of Amazon found that the previously available option of free shipping to Singapore for purchases of more than US \\( \\$ 125 \\) could now be enjoyed only by Amazon Prime members. \\( { }^{11} \\) The Competition Estimated to be about US \\( \\$ 1.4 \\) billion in 2017 , Singapore's e-commerce market was projected to grow Amazon: Facing Low Customer Satisfaction in Singapore SMU557-PDF-ENG 1. a. Companies often benchmark themselves on various key performance indicators' ratings. Howdoes Amazon.com perform on these key metrics as compared to its competitors? - Customer Satisfaction - Willingness to Recommend - Average customer spend - Frequency of visit b. From the data, what are the reasons for Amazon's performance ratings? - Which areas did Amazon perform well in? - Which areas did Amazon perform poorly in? 2. What should Amazon do to improve its customer satisfaction performance? 3. Compare the performance of Amazon with that of Qoo10. a. How is Qoo10 performing relative to Amazon? b. What should Amazon do to improve its performance? c. What should Amazon do to better compete with Qoo10? EXHIBIT 2: SIZE OF THF SAMPI F C.OI I FC:TFN FOR EACH COMPANY EXHIBIT 3: CUSTOMER SATISFACTION INDEX, SINGAPORE Customer Satisfaction Index of Singapore 2018 ( \\( \\epsilon \\) Source: Institute of Service Excellence@ SMU to US \\( \\$ 2.2 \\) billion by \\( 2023 .{ }^{12} \\) This growth was supported by various e-commerce companies such as Qoo10, Taobao/Tmall, Zalora, Lazada, and Redmart. Besides these, there were e-retailers such as Carousell and eBay that sold both used and new products on their platforms. The digital marketplace was highly competitive, and most players offered various discounts, coupons, deals and loyalty programmes, in an attempt to retain customers and encourage them to spend more. While Amazon depended on deliveries for fulfilment, some of the incumbents leveraged on rental lockers such as POP Stations for this purpose. SingPost, Singapore's postal service, provided more than 140 lockers across the island. Customers could place their orders online and opt to collect their orders at these lockers. Unlocking of these lockers was based on a pin sent to them via email or SMS by the sellers. \\( { }^{13} \\) This allowed customers to pick up their purchase at a place and time of their convenience without having to arrange for someone to be at home to wait for their deliveries. E-commerce companies were not the only ones that vied for customers in the digital marketplace. Brick-and-mortar companies, such as department stores and supermarkets, had begun to offer their products online as well. For instance, NTUC, a long-established brick-and-mortar supermarket chain, did not just revamp its online store but also built a new automated storage and retrieval system to aid in its fulfilment of online orders. \\( { }^{14} \\) By the end of 2017, Amazon managed to achieve a market share of only \11.5 in Singapore, while Qoo10, the market leader, was at \32.6 In terms of customer satisfaction, it continued to rank poorly on the CSISG, despite the launch of Amazon Prime. Lim pulled up some of the raw data that had been collected for a more detailed analysis. \\( { }^{16} \\mathrm{He} \\) knew that while the teething issues with the launches could have accounted for some of the adverse results, a thorough data analysis would not only help determine what Amazon lacked and why consumers preferred Qoo10 and other competitors over it, but also how the global e-retailer could possibly turn the situation around. EXHIBIT 1: DATA COLLECTION AND SAMPLING DETAILS The data was a subset of the survey data collected from Singaporeans and Permanent Residents via a randomised door-to-door methodology. Respondents were asked about their customer experience with the respective e-commerce website they had recently used in the last 3 months. Data were collected from January to April 2018. To qualify for the survey respondents were first asked which e-commerce sites they had used in the last 3 months, and then, based on the most recent site used, they were asked a series of questions regarding their experience with the site. Each respondent could only answer questions for one site. A total of \\( \\mathrm{N}=1600 \\) samples were collected. A quota of \\( \\mathrm{N}=200 \\) was set for the top 7 most used sites based on a separate internal study. Source: Institute of Service Excellence @ SMU SINGAPORE John Lim, the lead analyst at the Institute of Service Excellence (ISE) at Singapore Management University, was preparing for his meeting with James Mckally, senior partner at E-Consumer, a Singapore-based marketing consultancy on e-retail. One of the key roles of ISE was to conduct and release the results of the Customer Satisfaction Index of Singapore (CSISG) to both the media as well as the industry. \\( { }^{1} \\) Launched in April 2008, the CSISG covered more than 20 sub-sectors and measured over 100 companies from finance, insurance, info-communications, transportation, retail, food and beverage, healthcare, education, tourism, hotels, and more. \\( { }^{2} \\) Data for the e-commerce sub-sector was typically collected in the first quarter of every year. Respondents were interviewed using a randomised doorto-door methodology. Only respondents who had used the respective e-commerce site in the previous three months were eligible to be surveyed (refer to Exhibits 1 and 2). Lim was responsible for the accuracy of the data collected and the insights derived, and as a practice always double-checked the data received from the fieldwork vendors and the subsequent analytic tables generated. Only upon finding everything in order would he go ahead with the official release. A week earlier, on 27 June 2018, Lim had released the latest CSISG survey results for the ecommerce sub-sector - which showed that Amazon ranked last in terms of customer satisfaction in Singapore (refer to Exhibit 3). Despite the marginal increase in scores from 70-points in 2017 to 71points in 2018 , the e-retailer continued to rank the lowest among the e-commerce retail sites measured by the index. The results were unexpected, as Amazon was typically seen topping customer satisfaction surveys in the US. \\( { }^{3} \\) Even the American Customer Satisfaction Index (ACSI), an index that used a methodology similar to the CSISG, saw Amazon scoring 82-points and ranking a close second to retailer Costco's 83 -points. \\( { }^{4} \\) Surprised at the findings, Mckally, who was in the process of making a business pitch to Amazon, had sought a meeting with Lim at ISE in order to better understand the performance challenges Amazon faced in Singapore. To prepare for the upcoming discussion, Lim was reviewing the survey

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts