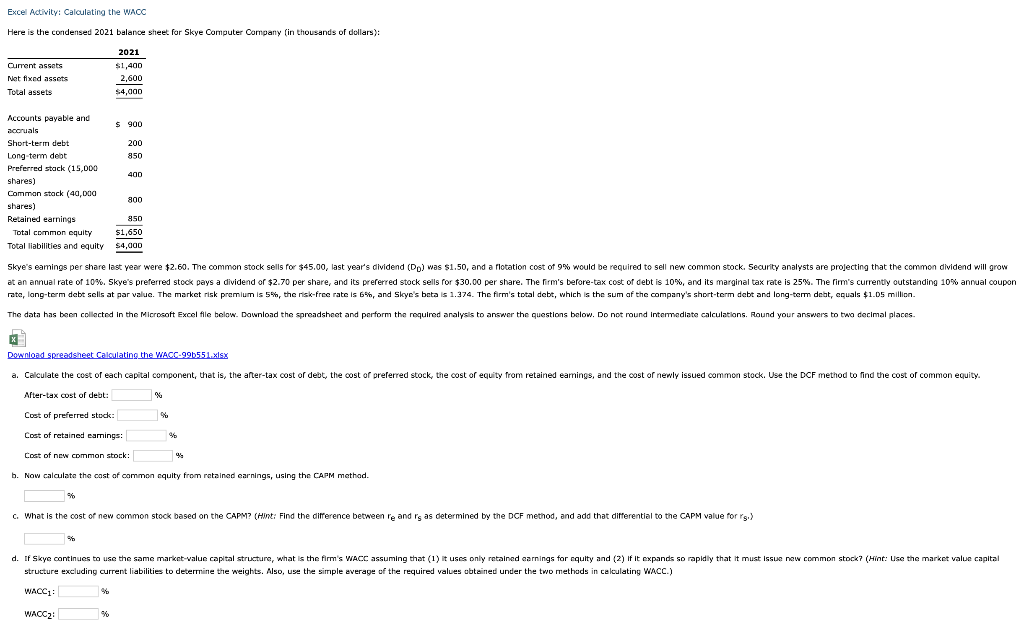

Question: DATA BELOW: Excel Activity: Calculating the whoc Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars): Download spreadsheet caloulating

DATA BELOW:

DATA BELOW:

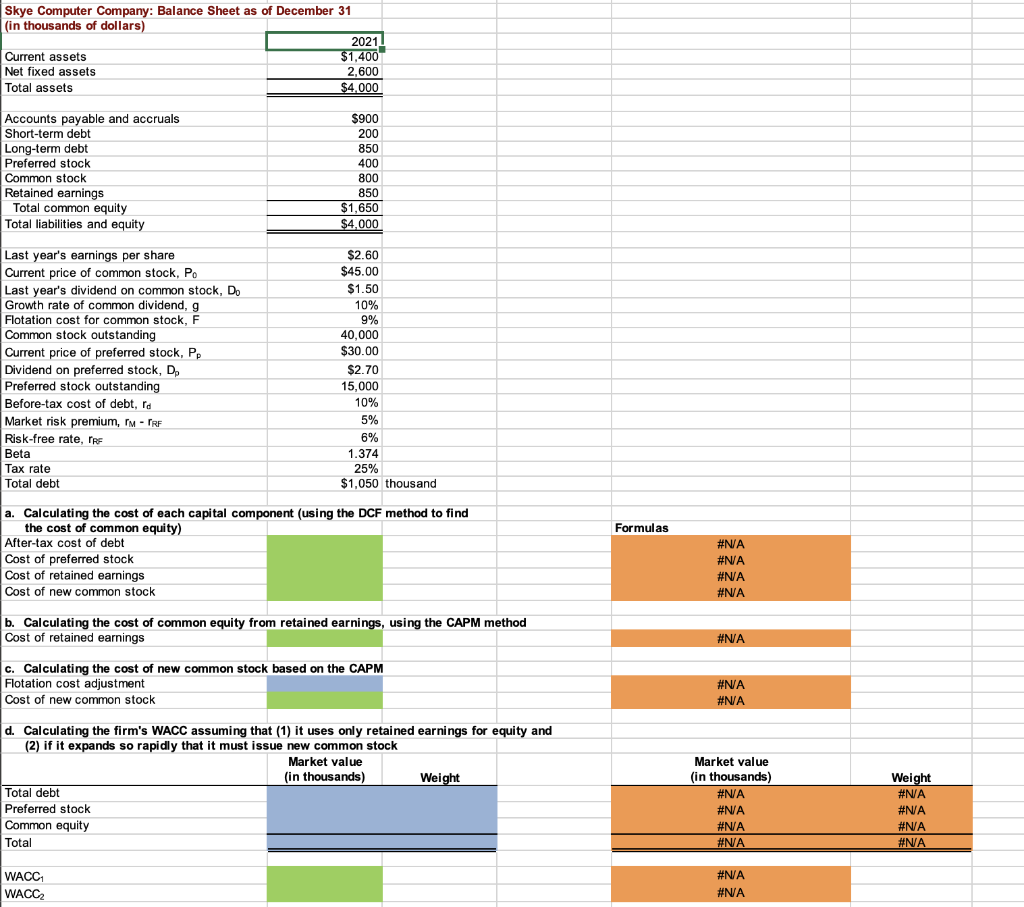

Excel Activity: Calculating the whoc Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars): Download spreadsheet caloulating the WaCC-99b551.xisx After-tax cost of debt: Cost of preferred stodk: Coet of retained eamings: Coat of new common stock: b. Now calculate the cost of common squity from ratained earnings, using the CAPM methad. structure excluding current liabilities to determine the weights. Also, use the simple average of the required values abtained under the two methads in calculating WacC.) WACC1 3b Skye Computer Company: Balance Sheet as of December 31 (in thousands of dollars) Current assets Net fixed assets Total assets \begin{tabular}{|r|} \hline 2021 \\ \hline$1,400 \\ \hline 2,600 \\ \hline$4,000 \\ \hline \end{tabular} Accounts payable and accruals Short-term debt $900200 Long-term debt Preferred stock Common stock Retained earnings Total common equity Total liabilities and equity 850$1,650$4,000 Last year's earnings per share Current price of common stock, P0 Last year's dividend on common stock, D0 Growth rate of common dividend, g Flotation cost for common stock, F Common stock outstanding Current price of preferred stock, Pp Dividend on preferred stock, D Preferred stock outstanding Before-tax cost of debt, rd Market risk premium, rMrRF Risk-free rate, rPF Beta Tax rate Total debt a. Calculating the cost of each capital component (using the DCF method to find the cost of common equity) Formulas \begin{tabular}{l|l|l} After-tax cost of debt & & \#N/A \\ \hline Cost of preferred stock & & #N/A \\ \hline Cost of retained earnings & & \\ \hline Cost of new common stock & & \\ \hline \end{tabular} b. Calculating the cost of common equity from retained earnings, using the CAPM method Cost of retained earnings c. Calculating the cost of new common stock based on the CAPM Flotation cost adjustment \#N/A Cost of new common stock d. Calculating the firm's WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts