Question: Data Case 237 31. HMK Enterprises would like to raise $14 million to invest in capital expenditures. The company plans to issue five-year bonds with

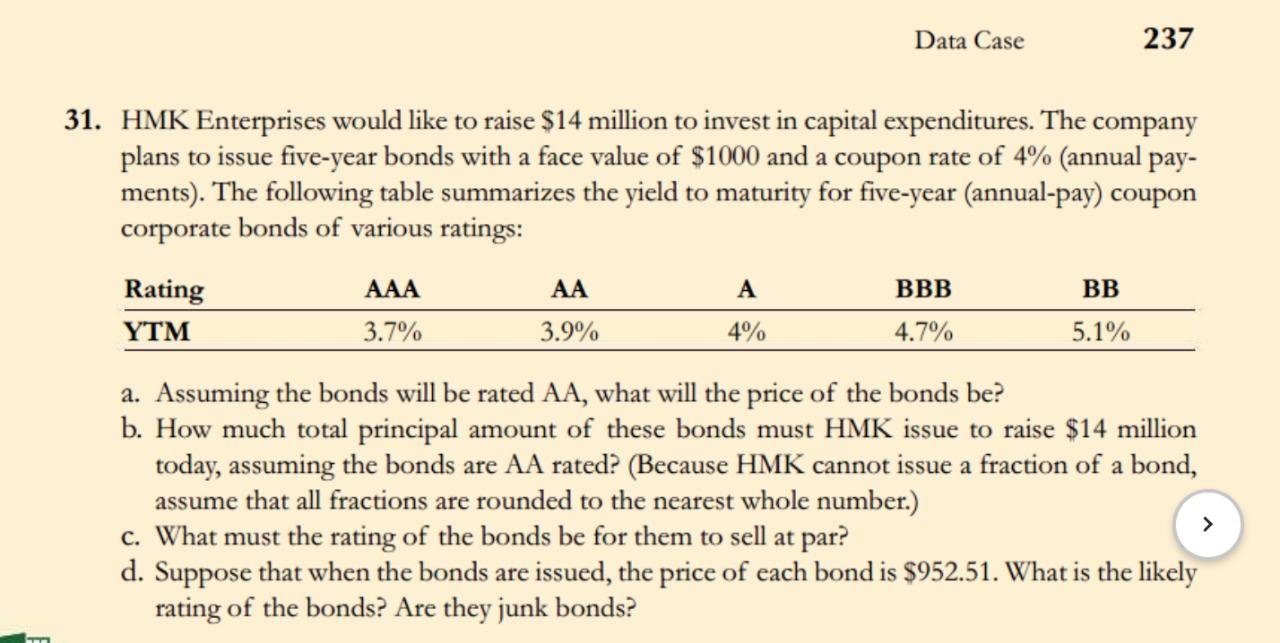

Data Case 237 31. HMK Enterprises would like to raise $14 million to invest in capital expenditures. The company plans to issue five-year bonds with a face value of $1000 and a coupon rate of 4% (annual pay- ments). The following table summarizes the yield to maturity for five-year (annual-pay) coupon corporate bonds of various ratings: AAA AA A BBB BB Rating YTM 3.7% 3.9% 4% 4.7% 5.1% a. Assuming the bonds will be rated AA, what will the price of the bonds be? b. How much total principal amount of these bonds must HMK issue to raise $14 million today, assuming the bonds are AA rated? (Because HMK cannot issue a fraction of a bond, assume that all fractions are rounded to the nearest whole number.) c. What must the rating of the bonds be for them to sell at par? d. Suppose that when the bonds are issued, the price of each bond is $952.51. What is the likely rating of the bonds? Are they junk bonds? >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts